Online help

Credit risk management »

How to validate credit limits requests?

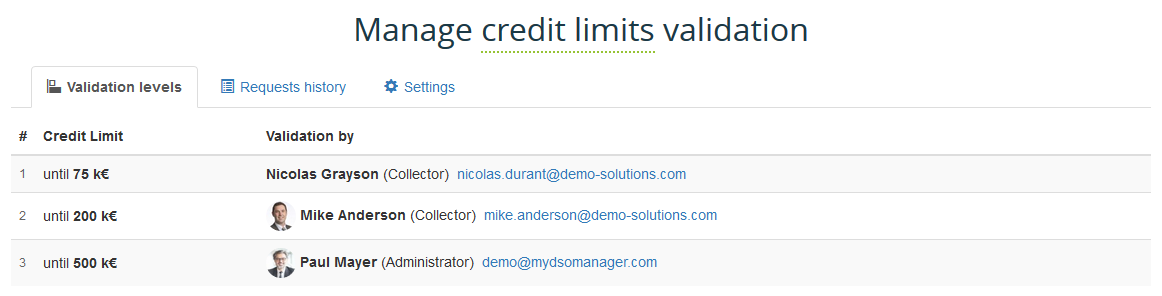

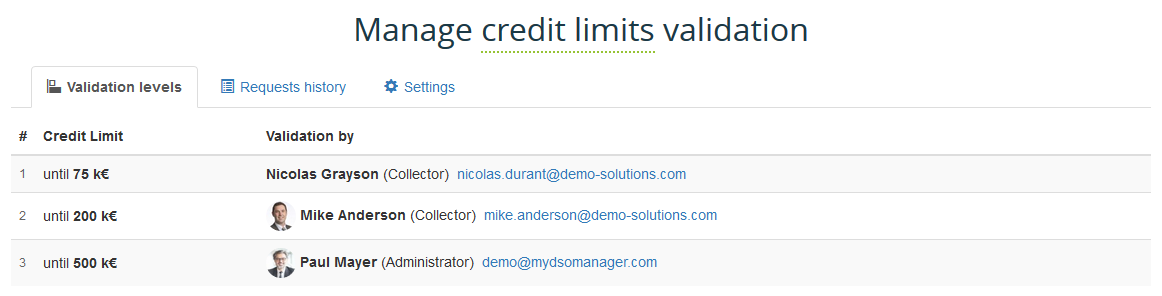

The validation levels of the credit limits can be set in Settings / Manage credit limits validation:

(these elements are configurable / modifiable by your Administrator / Credit Manager)

The credit limits validations can be managed:

1 From the customer file :

Fly over the credit limit to know it's state:

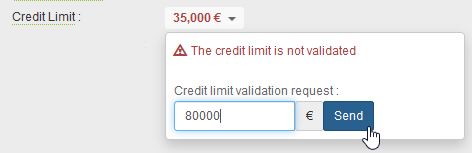

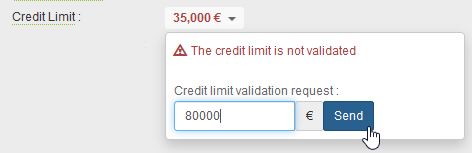

Enter and send the credit limit amount to validate:

The validator(s) receives an email with a link to approve the credit limit validation request. He must be created in My DSO Manager in order to directly access the request and validate (or reject) it from the customer's file, and thus have all the necessaries informations for decision making.

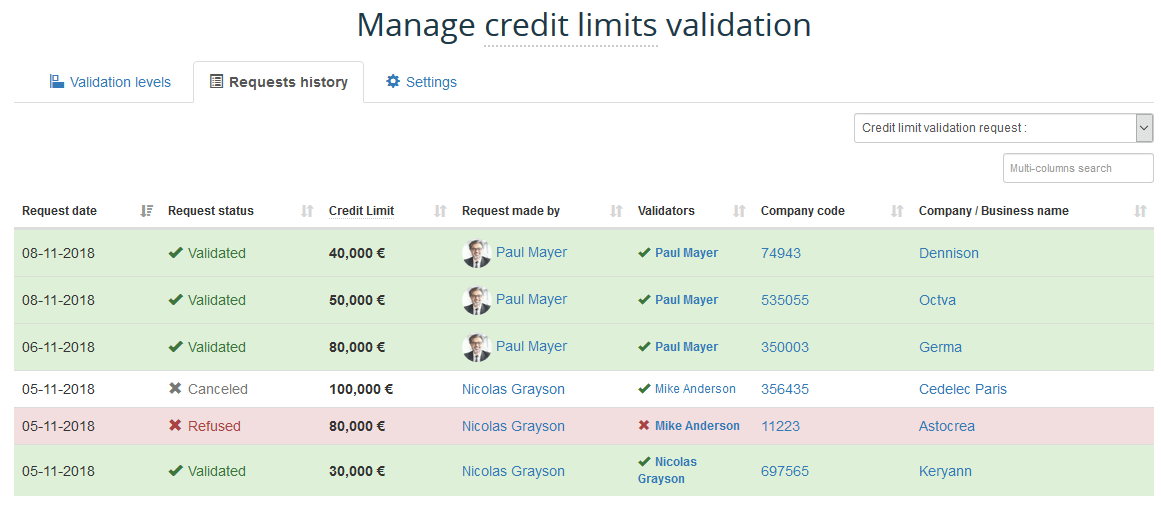

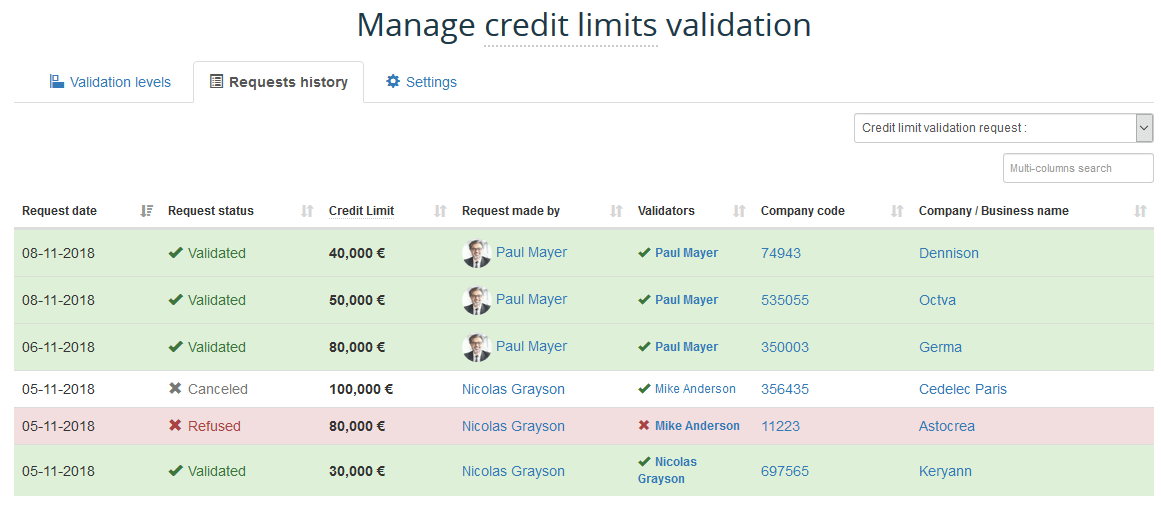

2 From Setting - Manage credit limits validation - Requests history :

Find all the requests that you can filter by their state:

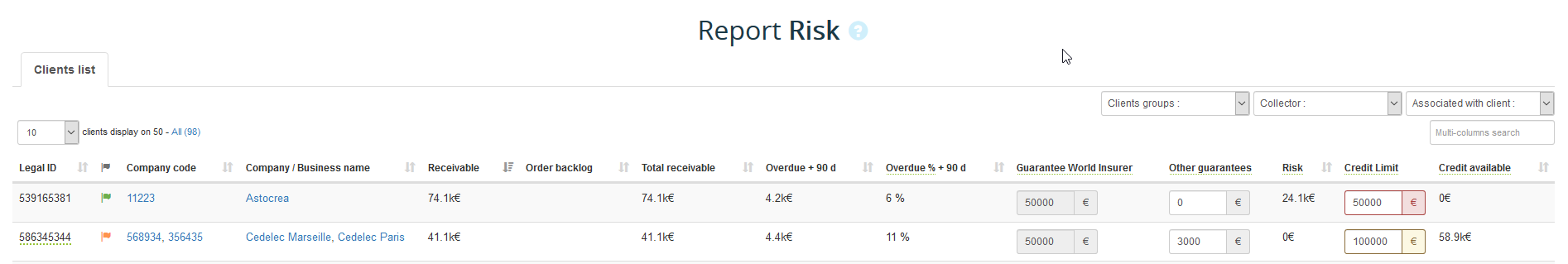

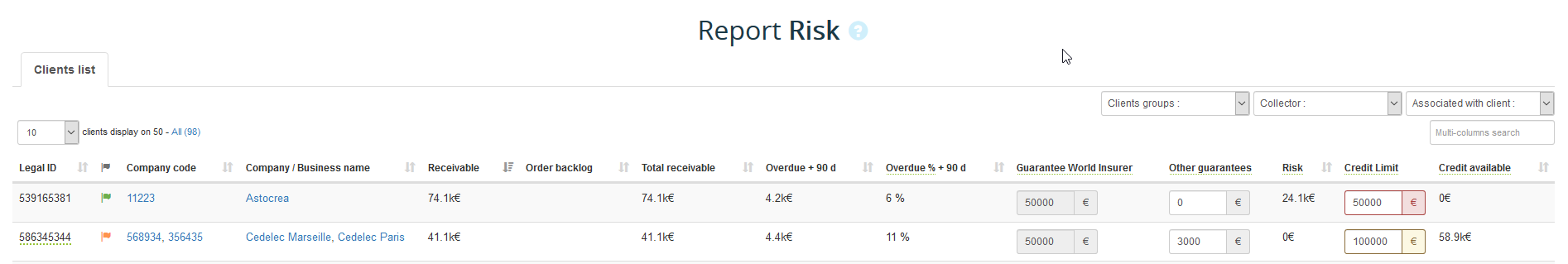

3 From the Risk report :

The risk report makes it possible to summarize the credit limits and their state (validated, not validated, pending ...).

(these elements are configurable / modifiable by your Administrator / Credit Manager)

Validation levels relate either to the unsecured amount of the credit limit : credit limit - guarantees (setup by default), either on the gross amount of the credit limit.

Contact us to update this setup.

Contact us to update this setup.

The credit limits validations can be managed:

1 From the customer file :

- Credit limits in red → limit « not validated » or « refused »

- Credit limits in orange → limit « waiting for validation »

- Credit limits in vert → limit « validated »

Fly over the credit limit to know it's state:

Enter and send the credit limit amount to validate:

The validator(s) receives an email with a link to approve the credit limit validation request. He must be created in My DSO Manager in order to directly access the request and validate (or reject) it from the customer's file, and thus have all the necessaries informations for decision making.

Once the validation process is completed, My DSO Manager sends an email to the requestor informing him of the validation (or rejection) of his request

2 From Setting - Manage credit limits validation - Requests history :

Find all the requests that you can filter by their state:

3 From the Risk report :

The risk report makes it possible to summarize the credit limits and their state (validated, not validated, pending ...).

Once the validation is done, in case of credit limit change, the amount has to be entered either manually from the customer's file or on the risk report, or by data import (according to your configuration)

← Back : Online help » Various questions