Examples of strategies with Search & Assign AI

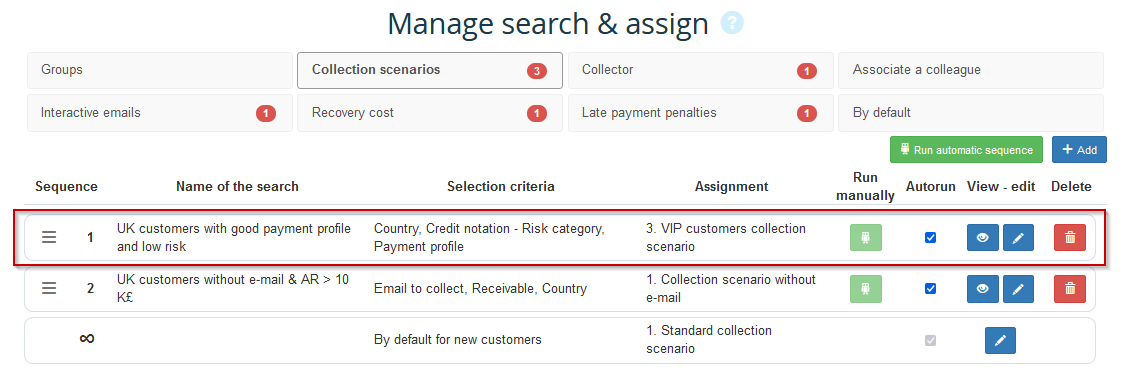

Search & Assign allows you to setup automatic and instant assignments at the customer account level in My DSO Manager based on all the data available on your platform. By laveraging both human and artificial intelligence, Search & Assign enhances your credit management, collection and real time reporting strategies. These capabilities extend to the following elements:

Assignment for each client:

- Collection scenario

- Collector/ Collection officers

- One or more customer groups

- Internal stakeholders and actors associated with the client (sales, customer service, ADV, etc.)

Activation or deactivation of the following features for each customer account:

- Interactive emails

- Late payment penalties

- Fixed collection fees

- Non-named (ND cover) or Discretionary Credit Limit (DCL) for users who activated a credit insurer connector

The number of criteria that can be used for these configurations, combined with the flexibility of My DSO Manager to create scenarios, collection models, or customers groups, make the number of possibilities virtually limitless.

Given the vast range of possibilities, it is crucial to be attentive and cautious to avoid incorrect configurations that could lead to negative consequences.

No worries, our tutorials and team are here to support you. Since these configurations are highly adaptable, any mistakes can be easily corrected.

Assignment of collection scenario based on customer typology

It is preferable to base your collection scenario assignments on sustainable criteria that do not change frequently. For example, the client's industry, the type of business (public or private), the payment method, the « business line » of your company to which your client is attached, etc.

However, it is of course possible to take into account other more volatile information: risk scoring, overdue payment amounts, payer profile, insurer guarantees, etc. In this case, it is recommended to create assignment rules that combine multiple criteria to ensure the scenario does not change too frequently.

A collection scenario spans several weeks, ensuring the consistency of actions taken. Therefore, it is preferable that the scenario does not change too frequently.

We can distinguish three levels of assignment: basic, progressive and advanced

1) Examples of basic assignments by:

- Sector of activity

- Customer segmentation specific to your company (specific field, group, etc.)

- Distinction between private and public companies

- Geographic criteria

- Risk criteria (scores, insurer guarantees, etc.)

- Payer profile

- Payment methods(direct debits, bank transfer, documentary credit, etc.), payment terms and deadlines

- By collection media (email available or not). Action to collect the right information then switch scenario.

2) Progressive assignments with a combination of multiple variable criteria and multiple assignments. For example:

- If a customer has a payment delay of more than 30 days, a deteriorating payer profile, and a decreasing risk score, a « risky customer » scenario can be assigned. This can also be grouped under « Risky Clients », allowing for very close monitoring.

Ensure that a dunning scenario is not assigned solely based on the number of days past due. This metric can fluctuate significantly over time and such a rule would lead to frequent changes of scenarios, which is not desirable unless the scenarios in question align with a coherent strategy.

For example, a standard scenario can be used initially, and then once the delay exceeds xx days, another scenario that includes only level 2 actions is assigned to the client.

- Creation of a customized, automated, and dynamic scoring system that takes into account all desired criteria. Three steps to follow for this:

- Create customer groups in advance corresponding to the possible outcomes. For example: Low Risk, Medium Risk, High Risk.

- Next, define and save searches corresponding to the criteria considered for each of the three possible scores. For example, based on the amount of delay, payment behavior, the score from your financial information provider or credit insurer, the country, and the sector of activity, etc.

- Finally, associate each search with the corresponding group.

3) Advanced assignments with a combination of several variable criteria and multiple assignments. For example:

- For a significantly overdue client whose indicators are in the red, assignment of a pre-litigation or litigation scenario is appropriate. This includes activating late payment penalties, and the fixed recovery fee, and assigning a recovery specialist focused on difficult cases. The same search created to identify these customers can be used to carry out multiple assignments in the same time.

- Successive and dynamic assignments. You have created dynamic scoring system with Search & Assign. This allows for the assignment of a scenario and a collection manager based on the client groups corresponding to the scoring.

- Dynamic creation of customer groups corresponding to your company's customer segmentations, then assignment of collectors or salespeople so that everyone has their customer portfolio in My DSO Manager and can filter reports and calendars accordingly.

Multiple possibilities exist depending on your organization and your company's collection processes. The only limits are those of our imagination rather than the scope of what is possible. Practice opening your mind and imagine the assignments you would like to make, free from any constraints.

The essential goal, of course, is to make assignments that are relevant for your team's organization and the effective application of your practices.

These advanced features, combining human and artificial intelligence, can lead you to rethink other settings in My DSO Manager and, more importantly, evolve your practices. This includes more targeted collection scenarios for specific situations and payer profile rules more closely aligned with your operational practices, among others.

This can also drive you to evolve your organization as a credit management and collection team: with increased specialization of recovery agents and automated management of each client based on their profile and characteristics, whether they are difficult and risky or, on the contrary, good payers acting as reliable partners.