Create a credit-insurer claim alert

A credit insurance contract is managed on a daily basis. Beyond any compensation, it is useful as a preventive measure and encourages the application of good practices in the management of trade receivables.

One of the clauses of a credit insurance contract defines a maximum period for declaring an outstanding payment to the insurer. The objective is threefold:

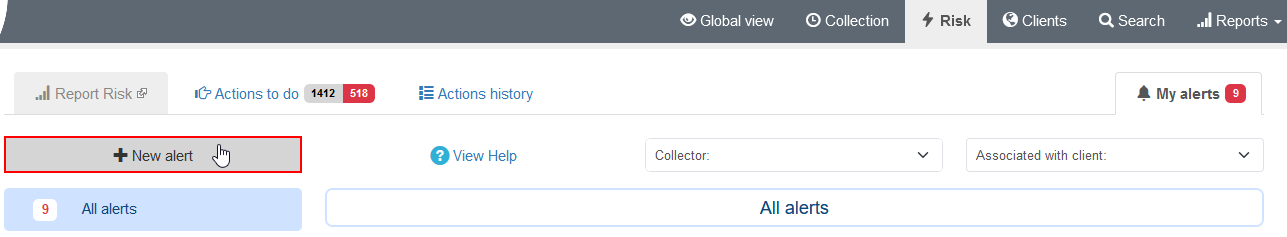

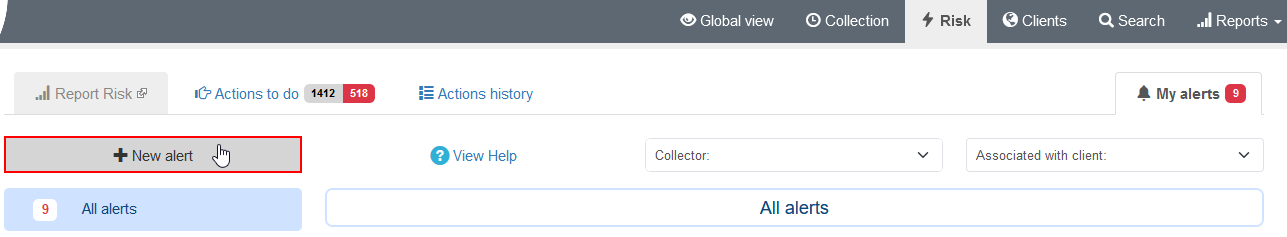

Go to the risk or collection agenda then click on "My alerts" and "New alert".

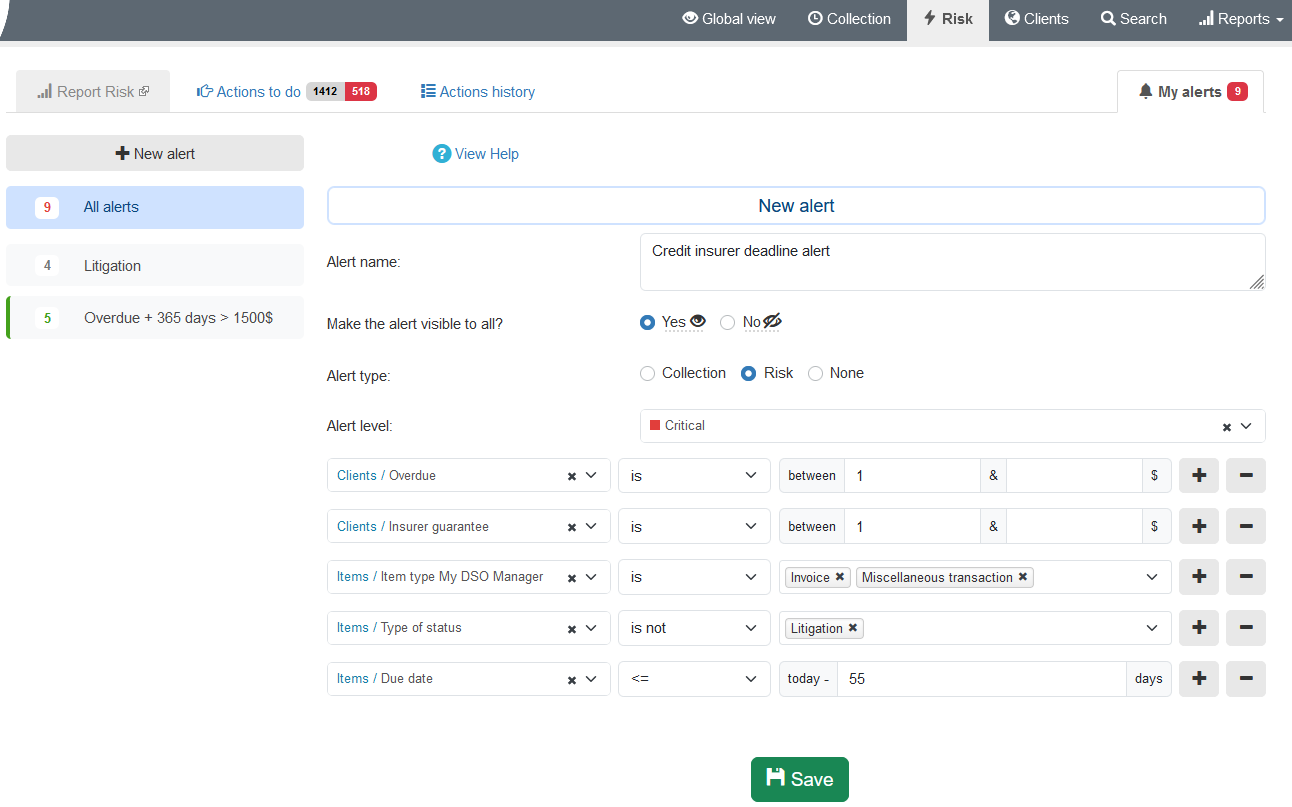

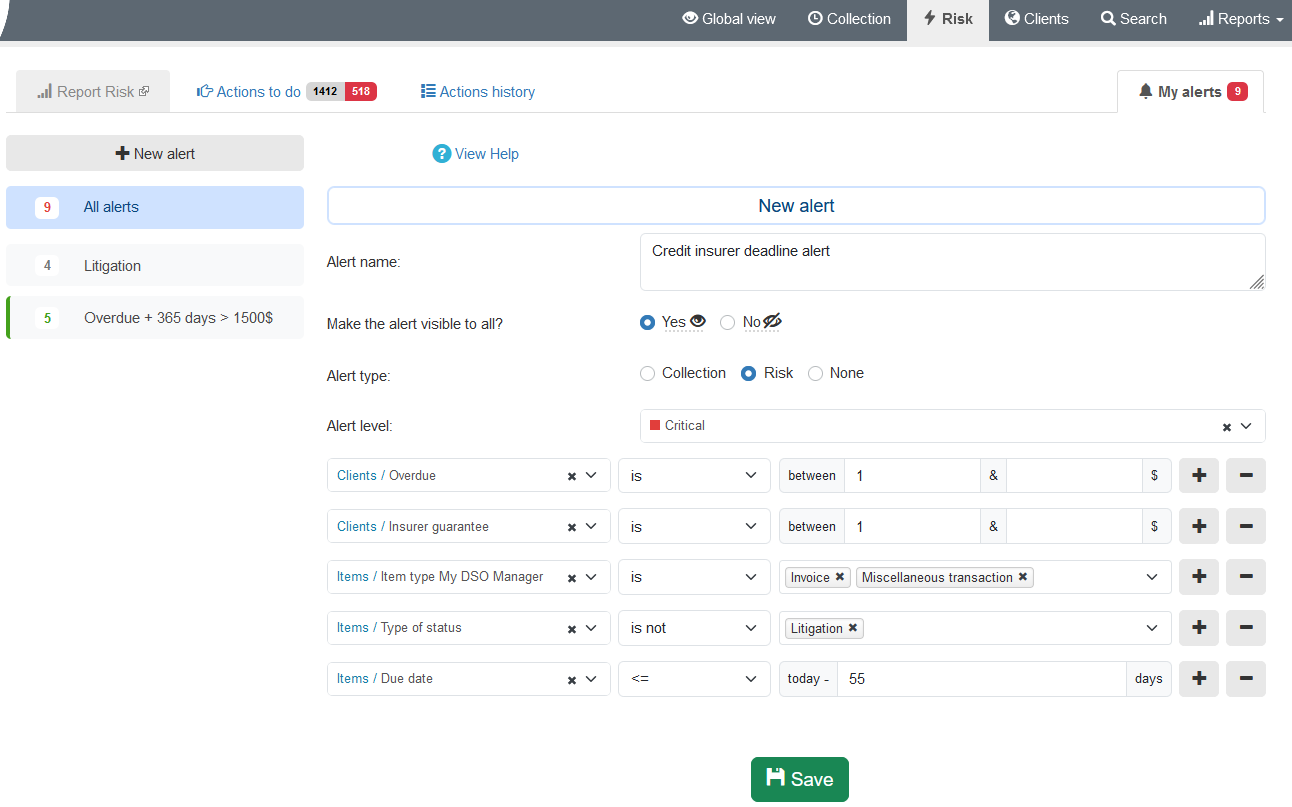

Fill in the name of the alert, the types of documents to be taken into account, the contractual deadline minus a few days (in order to anticipate this deadline), check your credit insurance contract for this, then select only the customers late in payment, which have a guarantee greater than 1 and which have not already been declared (status different from "Credit insurer claim"), then validate.

It is done !

My DSO Manager will alert you on a daily basis to customer accounts that are approaching the fateful threshold of the maximum period for declaring unpaid debts, which gives you the opportunity to inform the customer of this in order to firmly encourage him to pay his due.

Don't forget to create a "Declaration to credit insurer" type status and to qualify the receivables transferred with it. Thus, you will find in this alert only the new accounts to be declared.

One of the clauses of a credit insurance contract defines a maximum period for declaring an outstanding payment to the insurer. The objective is threefold:

- The probability of collection decreases rapidly with the passage of time, so it is advisable not to wait too long.

- This delay encourages the application of a dynamic recovery scenario with actions that follow one another in a coherent manner to get the customer to pay on time.

- It prevents a reprehensible practice which would consist in continuing to sell and invoice a customer who does not pay, to then declare and be compensated on a global unpaid.

- On the date of issue of the invoice, for example 120 days,

- On the due date, for example 60 days after.

How to create a suitable alert in My DSO Manager?

It's very easy 😊Go to the risk or collection agenda then click on "My alerts" and "New alert".

Fill in the name of the alert, the types of documents to be taken into account, the contractual deadline minus a few days (in order to anticipate this deadline), check your credit insurance contract for this, then select only the customers late in payment, which have a guarantee greater than 1 and which have not already been declared (status different from "Credit insurer claim"), then validate.

It is done !

My DSO Manager will alert you on a daily basis to customer accounts that are approaching the fateful threshold of the maximum period for declaring unpaid debts, which gives you the opportunity to inform the customer of this in order to firmly encourage him to pay his due.

Don't forget to create a "Declaration to credit insurer" type status and to qualify the receivables transferred with it. Thus, you will find in this alert only the new accounts to be declared.