Online help

Risk reporting »

What is the risk reporting?

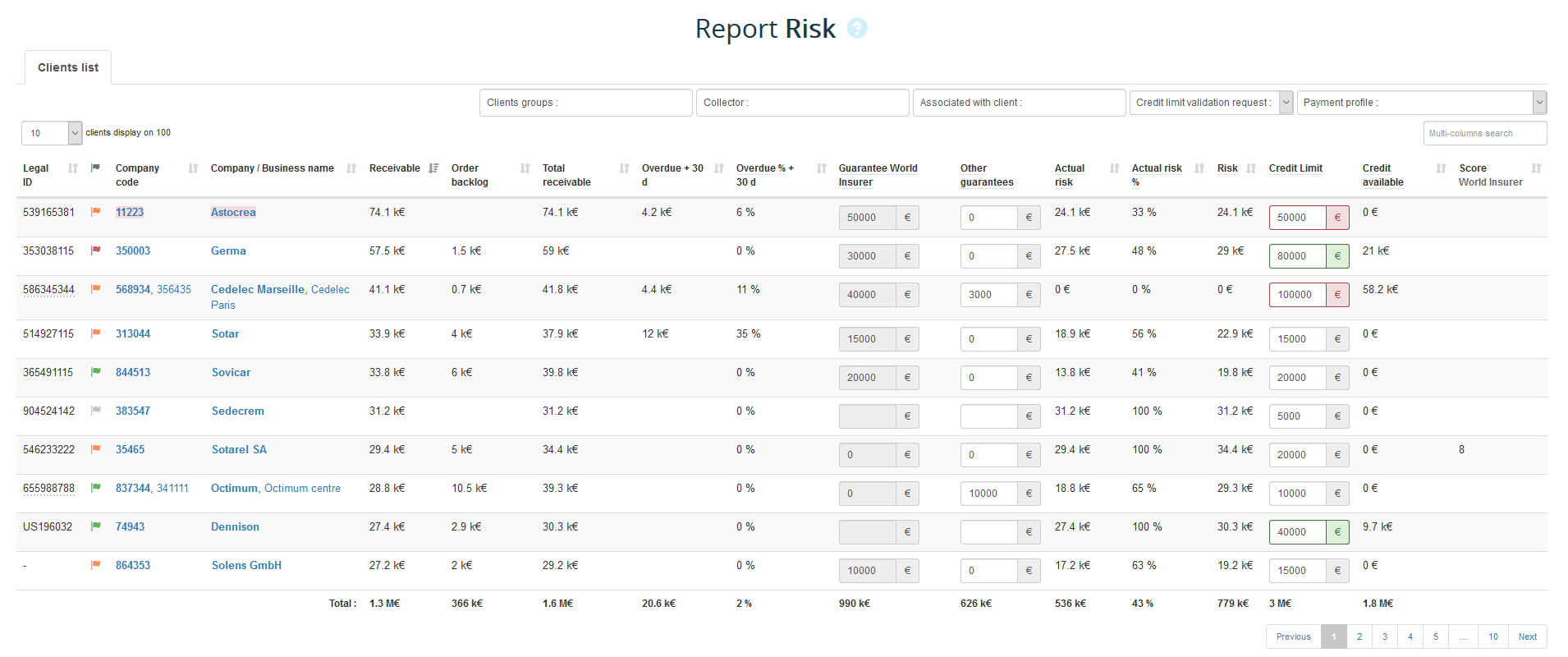

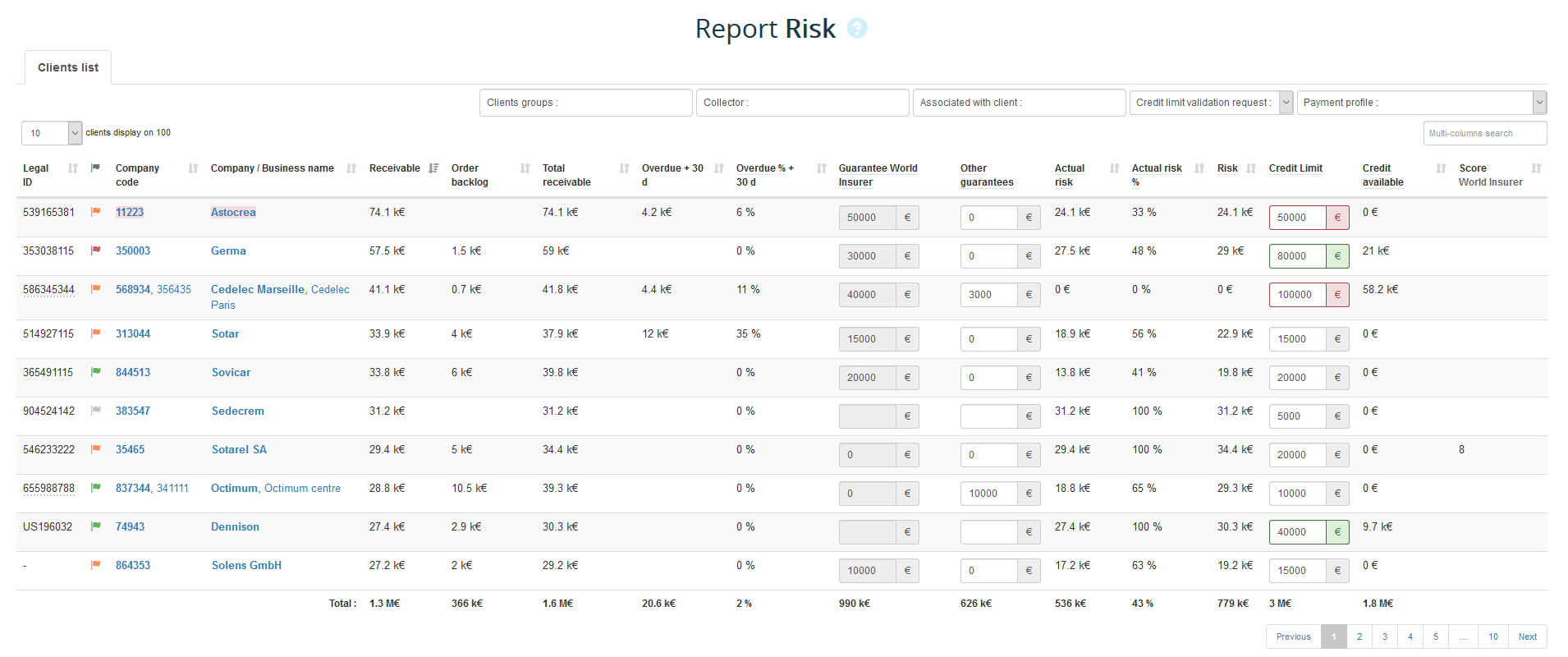

The risk report is used to view in a few clicks outstanding of each client and compare them to any guarantees and credit limit granted.

is used to view in a few clicks outstanding of each client and compare them to any guarantees and credit limit granted.

It is an operational tool to manage receivable exposure and make sure risk is mitigated and under control.

It highlights the risk outstanding and credit available for every buyer.

The customer risk is assessed at the level of the legal entity. If several accounts are linked to the same legal ID, the tool consolidates outstanding accounts concerned in order to have the global exposure.

It is an operational tool to manage receivable exposure and make sure risk is mitigated and under control.

It highlights the risk outstanding and credit available for every buyer.

Report available in the entity

The customer risk is assessed at the level of the legal entity. If several accounts are linked to the same legal ID, the tool consolidates outstanding accounts concerned in order to have the global exposure.

This report allows a credit risk monitoring based on real outstanding and credit limit granted. Financial information provider scoring (credit limit, notation, ...) like Creditsafe, Dun and Bradstreet, ..., are also displayed here.

The fields Credit limit (that you set according to your criteria), Insurer guarantee (if you have a credit insurance contract) and Other guarantees (bank guarantee, documentary credit ...) are associated with the legal entity and not on accounts individual.

It's possible to import the amount of order backlog per customer (orders received not invoiced yet). This information is added to the receivables to obtain the total outstanding amount of an account, which is then compared to the credit limit and the insurer's guarantee to determine the residual risk.

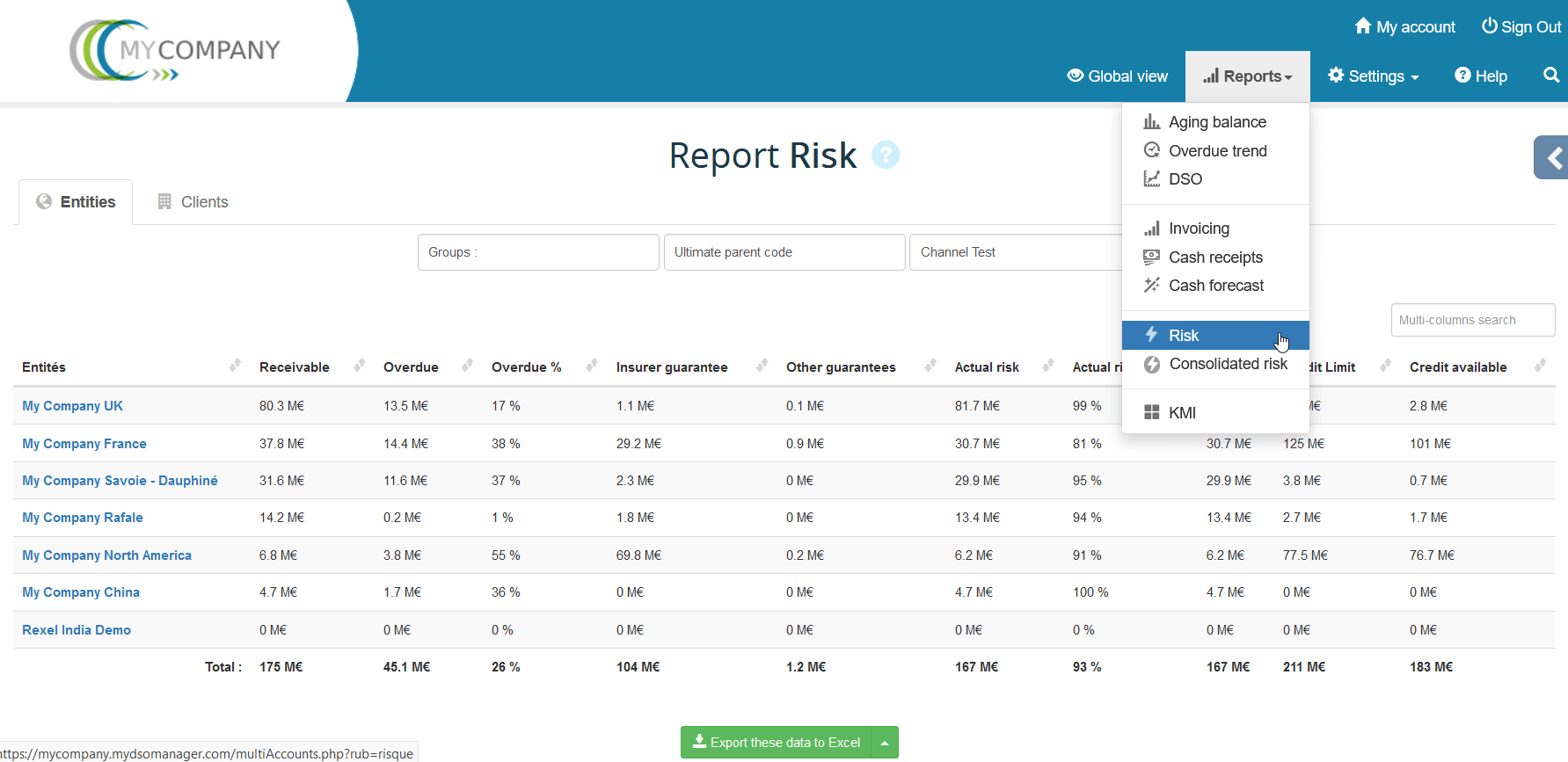

Report available at the Multi-entity level

For multi-entities platforms, a consolidated risk report

← Back : Online help » Various questions