Online help

Credit risk management »

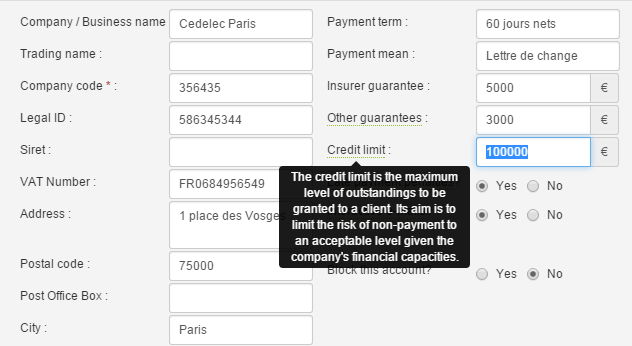

How to manage credit limit?

The credit limit is the maximum amount of Accounts Receivable that your company accepts to own with a given customer.

It depends on the volume of business forecasted with the buyer, the payment term granted and its financial capacities.

In My DSO Manager , the credit limit is managed at the legal entity level. If you have multiple accounts that belong to the same legal entity, the credit limit has to be checked compare to the consolidated receivable of all of these accounts. This consolidation is based on the Legal ID field of customers' data.

There is one credit limit for one legal entity. If you change it in a customer account, it will be automatically updated on other accounts with same legal ID.

It depends on the volume of business forecasted with the buyer, the payment term granted and its financial capacities.

The credit limit is not necessarily the output of the Insurer guarantee and Other guarantees. It is defined with several criteria that can integrate these two fields or not.

In My DSO Manager , the credit limit is managed at the legal entity level. If you have multiple accounts that belong to the same legal entity, the credit limit has to be checked compare to the consolidated receivable of all of these accounts. This consolidation is based on the Legal ID field of customers' data.

There is one credit limit for one legal entity. If you change it in a customer account, it will be automatically updated on other accounts with same legal ID.

This principle is the same for the fields: « Insurer guarantee » and « Other guarantees ».

In the customer Risk report tab tab, information and credit analyzes are necessarily done at the the legal entity level.

In the Risk report, receivable data are consolidated at the level of the legal entity in order to have a global view of the exposure with a given company.

report, receivable data are consolidated at the level of the legal entity in order to have a global view of the exposure with a given company.

It is also possible to update the credit limit in the Risk report by entering the amount directly in the table listing the customers.

report by entering the amount directly in the table listing the customers.

In the Risk

It is also possible to update the credit limit in the Risk

It is possible to import and update this field with the import of customer data.

A tool to calculate the credit limit is available in the customer sheet, tab Risk report tab.

Manage credit limit validations from My DSO Manager. To see more:

How to create or modify credit limit validation levels?

How to validate credit limits?

How to create or modify credit limit validation levels?

How to validate credit limits?

← Back : Online help » Various questions