Online help

Credit risk management »

What is the credit limit calculation tool?

This tool calculates the outstanding need with your buyer, based on the volume of business coming and payment terms granted. It compares then the result (theoretical credit limit) with its financial capabilities to determine the acceptable credit limit.

It is based by default on two financial criteria:

These criteria can be modified by clicking on Customize scoring criteria.

The objective is to define a credit limit that is consistent with the financial capabilities of the buyer.

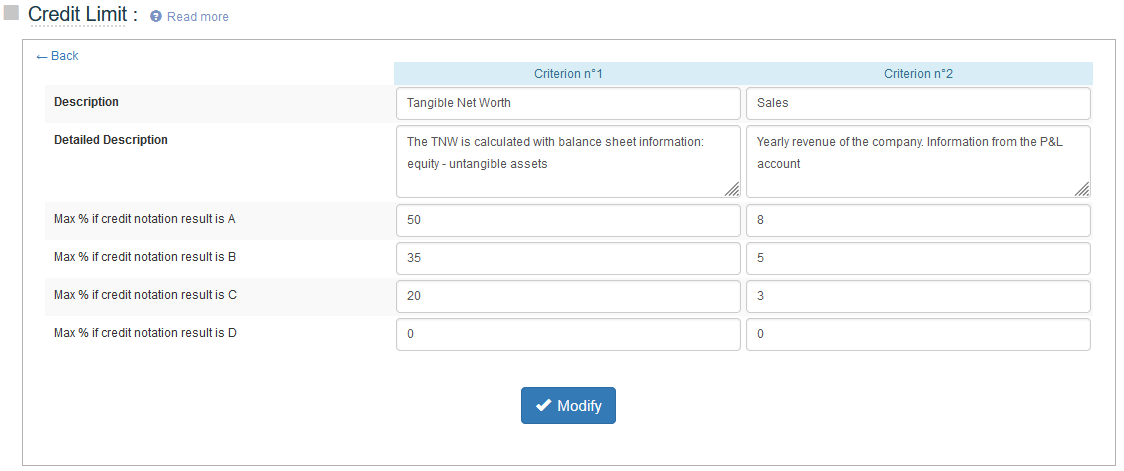

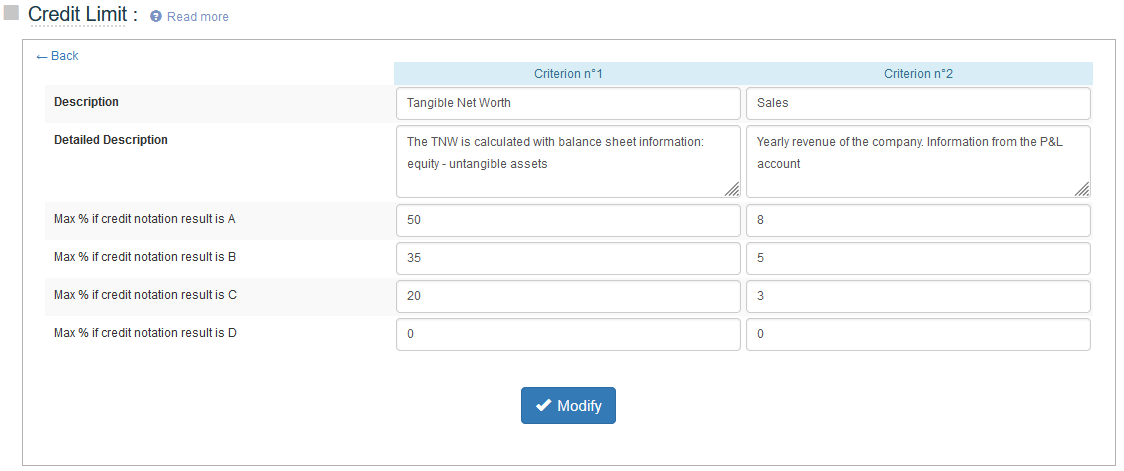

According to the result of the credit notation, the acceptable credit limit will be at most equal to the percentage of the TNW or the turnover defined.

→ Learn more: What is the credit notation?

Example of calculation using the following assumptions:

You can save the result of the calculation to keep the history.

It is based by default on two financial criteria:

- The Tangible Net Worth (TNW, equity minus intangible assets)

- The Turnover

These criteria can be modified by clicking on Customize scoring criteria.

The objective is to define a credit limit that is consistent with the financial capabilities of the buyer.

If the acceptable credit limit is insufficient in relation to future sales, it is necessary to negotiate shorter payment terms and / or obtain third-party payment guarantees (bank, insurance ...) in order to secure the commitments.

According to the result of the credit notation, the acceptable credit limit will be at most equal to the percentage of the TNW or the turnover defined.

→ Learn more: What is the credit notation?

Example of calculation using the following assumptions:

- The Sales forecast (outstanding need) is 250 000 euros. the calculated Theorical credit limit (credit limit need) is 50 000 euros

- The TNW of the customer is 80 000 euros

- Its yearly turnover is 700 000 euros

- Credit notation result is B

The acceptable credit limit is then 28 000 euros, as the most restrictive criteria applies.

You can save the result of the calculation to keep the history.

To update the credit limit, it is necessary to update the customer file or the information in your ERP.

→ Learn more: How to manage credit limit?

→ Learn more: How to manage credit limit?

← Back : Online help » Various questions