Online help

Cash forecast report »

What is the cash forecast report?

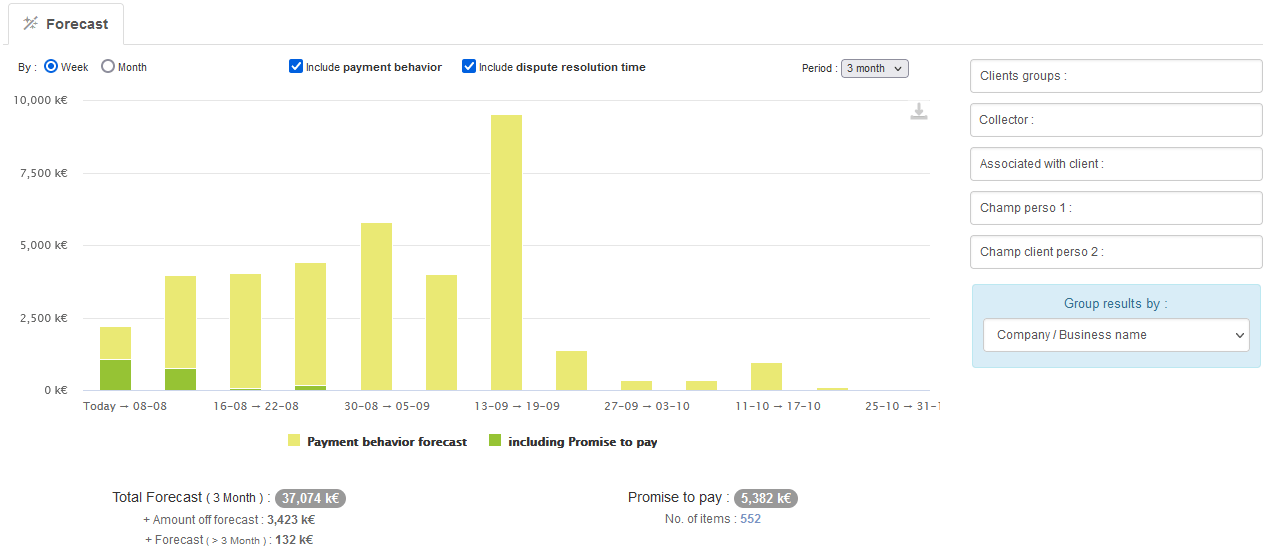

This report provides a forecast of cash receipts coming from your customers.

It is based both on the work of the collector (qualification of items with appropriate status), the performance of your business in disputes resolution and customer payment behavior recorded by My DSO Manager.

It is possible to have an overall view taking into account all of these criteria, or focus only on the promises of payment with dedicated check boxes, located above the graph.

The report can be filtered by customer group, collector, internal actor (commercial ...) associated with customers and analytical field (if set).

Calculation criteria :

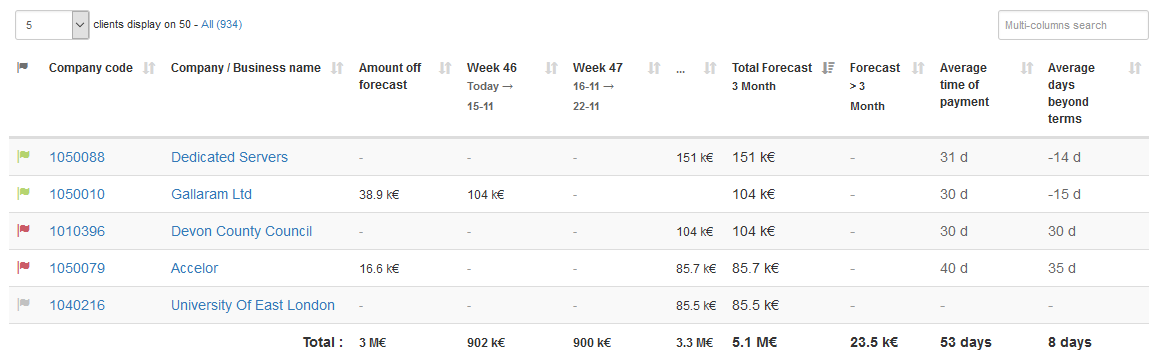

The table shows the cash forecast per customers. It can be sorted and filtered in many ways to target clients on which you want to focus on.

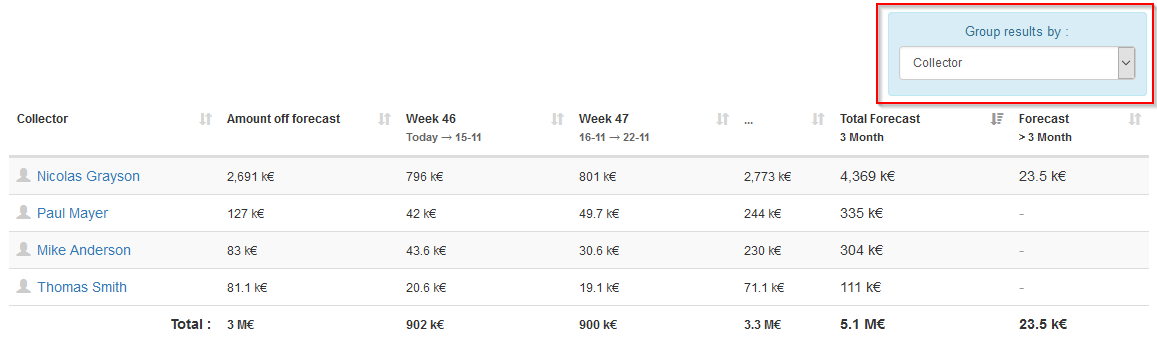

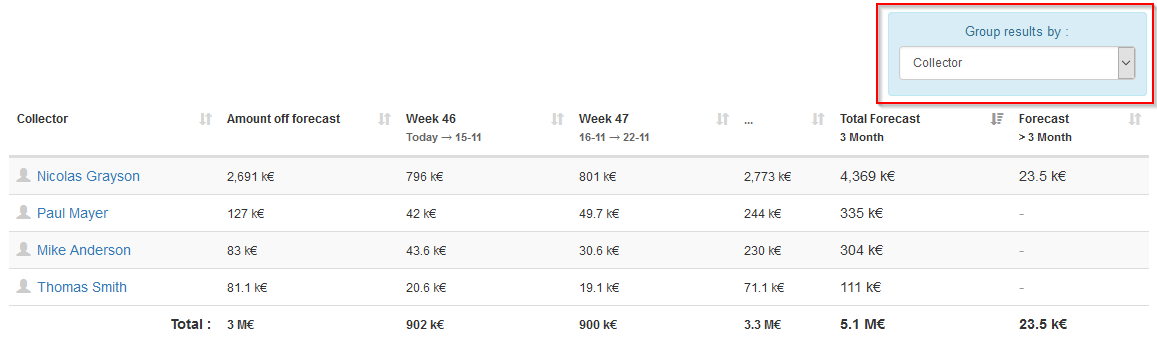

It is possible to « Group results » by collector and by any customer analytical field:

It is based both on the work of the collector (qualification of items with appropriate status), the performance of your business in disputes resolution and customer payment behavior recorded by My DSO Manager.

The graph

It is possible to have an overall view taking into account all of these criteria, or focus only on the promises of payment with dedicated check boxes, located above the graph.

The report can be filtered by customer group, collector, internal actor (commercial ...) associated with customers and analytical field (if set).

Calculation criteria :

- Promises to pay.

The report takes into account items qualified with a status « Promise to pay » for which a payment date was entered.

- Items qualified with a status type « Dispute ».

In this case, the collection forecast follows this rule: item due date + average resolution time for this dispute type + average payment delay of the customer.

- Non qualified items or with another type of status (on going, etc.).

The cash forecast follows this rule: item due date + average payment delay of the customer.

- Items qualified with a status « Litigation » are not taken into account in the forecast report.

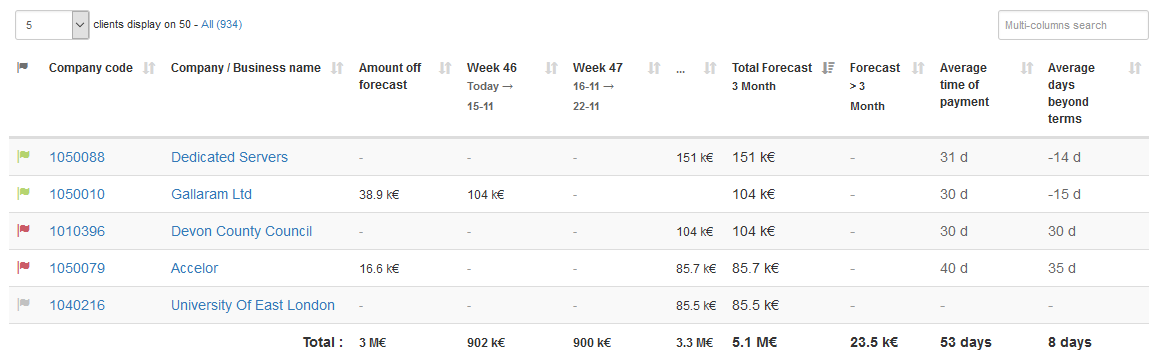

Items that do not have « respected » the forecast are sum up in as « Amount off forecast ».

For example, An old promise to pay that has not been respected by the customer (invoice still not paid) will appear in this « overdue off forecast » category.

For example, An old promise to pay that has not been respected by the customer (invoice still not paid) will appear in this « overdue off forecast » category.

The table

The table shows the cash forecast per customers. It can be sorted and filtered in many ways to target clients on which you want to focus on.

It is possible to « Group results » by collector and by any customer analytical field:

← Back : Online help » Various questions