Online help

Credit risk management »

How to manage your credit insurance?

Credit insurance is a tool offering several integrated services:

A credit insurance contract, like any insurance contract, includes numerous contractual clauses that must be respected in order to preserve one's right to compensation. It must therefore be managed on a daily basis and its rules must be integrated into the credit management processes.

There are several types of credit insurance, classical credit insurance, excess of loss, etc., and therefore several ways to manage them in My DSO Manager.

The main objectives are to have always up-to-date information concerning the amounts of guarantees and the contractual clauses of each policy, and to link this information with the situation of each customer account in order to carry out all the actions (declarations to the insurer, supported reminders of customers, adaptation of payment conditions, etc.) in a timely manner.

The interaction with insurers and / or your broker is done directly from My DSO Manager.

The guarantee data, score, etc. can come from either:

The amount of guarantee granted by the insurer (permanent, temporary, top up, etc.) is taken into account in the calculation of the risk and the actual risk.

1 Fill your credit insurer name in My account. This enables to activate all of the features related to credit insurance.

2 Import or insert information related to your credit policy with the available fields (non exhaustive list):

, risk agenda

, risk agenda , at the customer account level in credit risk tab, or with the Alerts

, at the customer account level in credit risk tab, or with the Alerts with the possibility of creating alerts in the event of the outstanding amount being exceeded compared to the amount covered by the insurer, or in the event of foreclosure or default, for example.

with the possibility of creating alerts in the event of the outstanding amount being exceeded compared to the amount covered by the insurer, or in the event of foreclosure or default, for example.

- Customer risk prevention: review of customer solvency.

- Monitoring: ongoing assessment of the customer portfolio.

- Debt collection: amicable or contentious collection actions in the event of a claim.

- Compensation: in the event of non-payment on a debt guaranteed by the insurer, the insurer compensates the insured based on the amount of the non-payment and the guaranteed portion.

A credit insurance contract, like any insurance contract, includes numerous contractual clauses that must be respected in order to preserve one's right to compensation. It must therefore be managed on a daily basis and its rules must be integrated into the credit management processes.

There are several types of credit insurance, classical credit insurance, excess of loss, etc., and therefore several ways to manage them in My DSO Manager.

The main objectives are to have always up-to-date information concerning the amounts of guarantees and the contractual clauses of each policy, and to link this information with the situation of each customer account in order to carry out all the actions (declarations to the insurer, supported reminders of customers, adaptation of payment conditions, etc.) in a timely manner.

The interaction with insurers and / or your broker is done directly from My DSO Manager.

First topic: the origin of the information

The guarantee data, score, etc. can come from either:

- the existing connector between My DSO Manager and your credit insurer. In this case, the data is automatically updated daily without you having to do anything.

The DCL (Discretionary Credit Limits) or ND (Non-Named) which are part of the contractual clauses, are rarely communicated by insurer connectors. Configure and adjust this amount according to the evolution of your contract in My DSO Manager via Settings / Manage risk and define via Search & Assign AI the rules for assigning automatically these guarantees. - of the import of the customer file in which the guarantee data can be included. In this case, the data source is your company's ERP, accounting software or CRM. This implies that the data is updated in this system.

- of the insurer's system with a manual update in your My DSO Manager platform of the guarantees and developments by editing the customer file or directly in the risk report

. This approach is possible but presents risks of error or omission. To avoid this risk, a regular comparison of information between the insurer's system and your data in My DSO Manager is necessary.

. This approach is possible but presents risks of error or omission. To avoid this risk, a regular comparison of information between the insurer's system and your data in My DSO Manager is necessary.

The amount of guarantee granted by the insurer (permanent, temporary, top up, etc.) is taken into account in the calculation of the risk and the actual risk.

Step two: enter the characteristics of your credit insurance

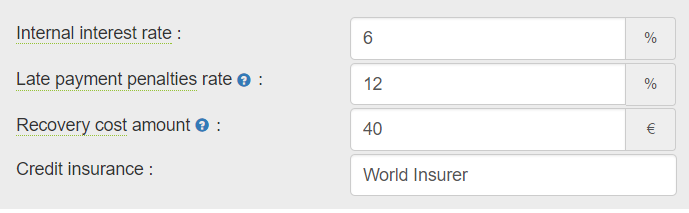

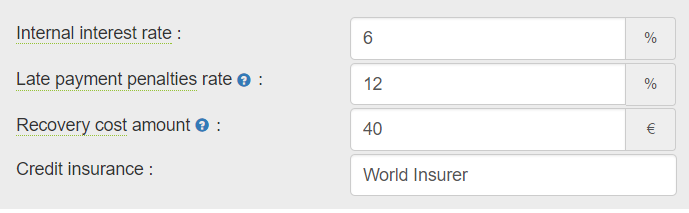

1 Fill your credit insurer name in My account. This enables to activate all of the features related to credit insurance.

2 Import or insert information related to your credit policy with the available fields (non exhaustive list):

- Insurer guarantee amount

- Temporary guarantee amount

- Starting date of the temporary guarantee

- Ending date

- Insurer reference

- Guarantee type*

- Insurer rating*

- Guarantees currency*

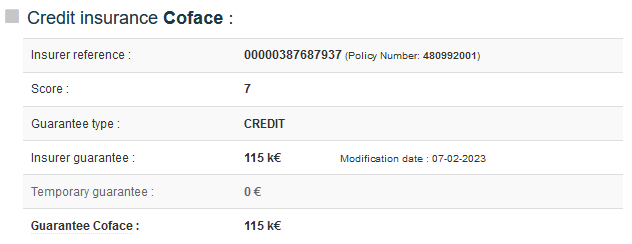

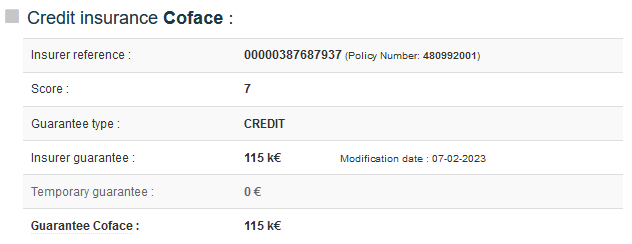

Then find these values in the « Risk report » tab of each customer account:

The total amount of the guarantee includes the insurer guarantee amount plus the temporary guarantee if it is valid (compared to the validity dates), and the top up if any.

3 Manage your exposure against your guarantees with Risk report4 Interact with the credit insurer and/or your credit insurance broker:

- Request for guarantees from the customer account file, possibly adding explanations for the insurer referee. Also track the status of each request inside the software.

- Request for assistance from your broker using pre-established emails.

- Claims declarations by completing the dedicated form and then qualifying the customer and/or the documents concerned.

- Turnover declaration: define the turnover declaration rules according to the scope (customers and documents to be integrated) with a saved advanced search and complete your declaration in a few clicks.

- Manage the performance and profitability of your credit insurance policy.

All of these operations can be carried out from your My DSO Manager platform as soon as the connector with your insurer is activated (depending on the insurer), except the last point (performance of the credit insurance policy) which also requires data from your broker or credit insurer (

This allows you to have all the information and actions in the same place concerning the management of your credit insurance, in connection with the other aspects of the management of your company's customer base.

5 Go further with My DSO Manager: depending on the level of coverage, and other credit risk assessment criteria, define the most relevant and appropriate collection strategies. With Search & Assign

← Back : Online help » Various questions