How to manage credit risk of multi-entity customers in My DSO Manager?

Assessing the creditworthiness of global customers and then adapting payment conditions accordingly are the first key steps to avoid bad debts and late payments. This is particularly true for multi-entity clients when it is historically difficult to have a consolidated view. Not with My DSO Manager :)

My DSO Manager, as a full Credit Management solution, allows to analyze and control credit risk with several integrated functionalities:

This functionality makes possible to get a consolidated view of outstandings and risk of a common client to several entities (or countries) of your Group as well as a global risk report for the entire group.

My DSO Manager, as a full Credit Management solution, allows to analyze and control credit risk with several integrated functionalities:

- Dynamic tracking of outstandings, guarantees management (credit insurers, banks, ...) and credit limits per customer.

- Global view with the risk report • Consolidation of customer risk by legal entity (if multiple accounts for the same customer).

- Risk agenda making it possible to manage overruns, credit limits reviews, litigation actions and any other customer risk management action.

- Customizable multi-criteria scoring templates, tool for calculating credit limits, daily credit analysis comments.

- Credit limit validation workflow • Customers' payment profiles • Alerts • ...

- Connectors with credit insurers and financial information providers:

Creditsafe,

Creditsafe,  Ellisphere,

Ellisphere,  Infolegale,

Infolegale,  Altares (Intuiz+),

Altares (Intuiz+),  DNBi (Dun & Bradstreet), ...

DNBi (Dun & Bradstreet), ...

Consolidate data from a multi-entity customer using the Ultimate Parent Number

This functionality makes possible to get a consolidated view of outstandings and risk of a common client to several entities (or countries) of your Group as well as a global risk report for the entire group.

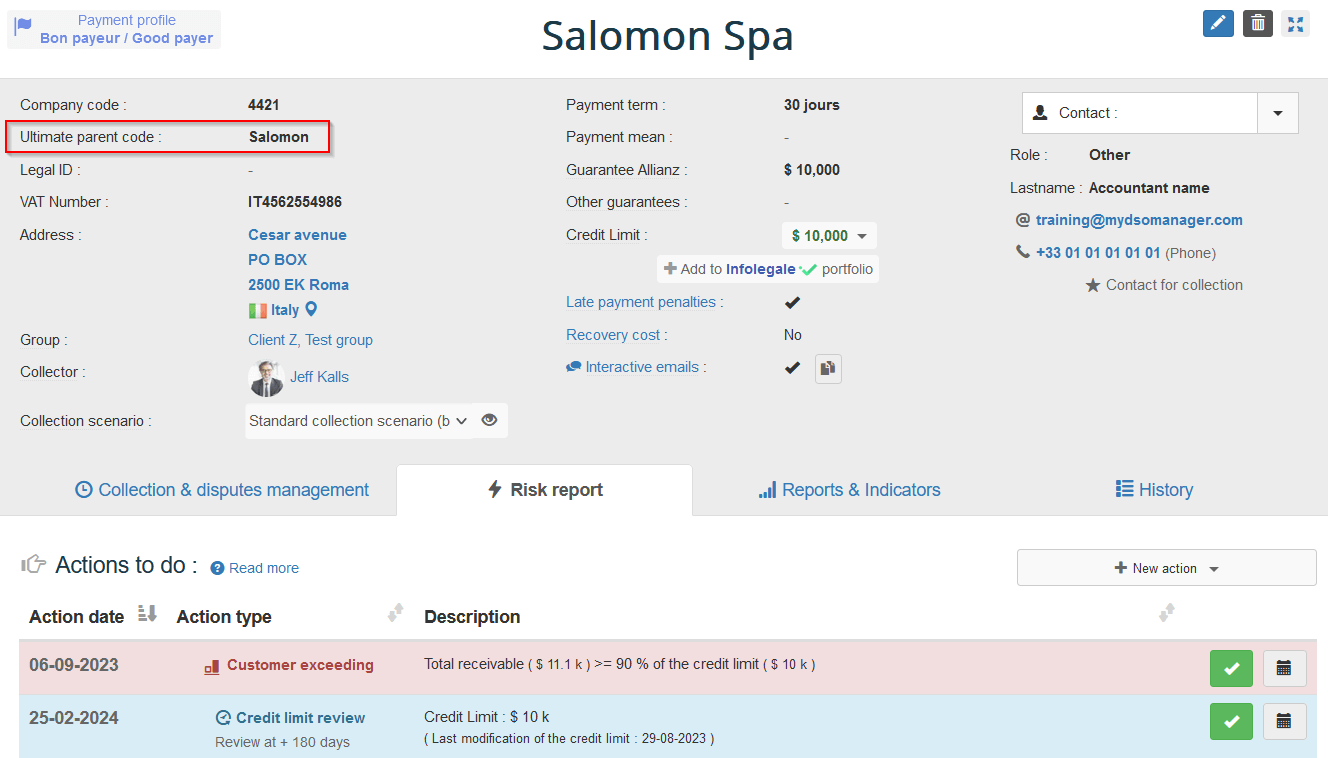

- Ultimate Parent Number → Do you have a common client to multiple entities in different countries? Add to each of the account concerned the same "Ultimate Parent Number" that allows to consolidate its data. This value can be uploaded automatically or added manually on each customer account.

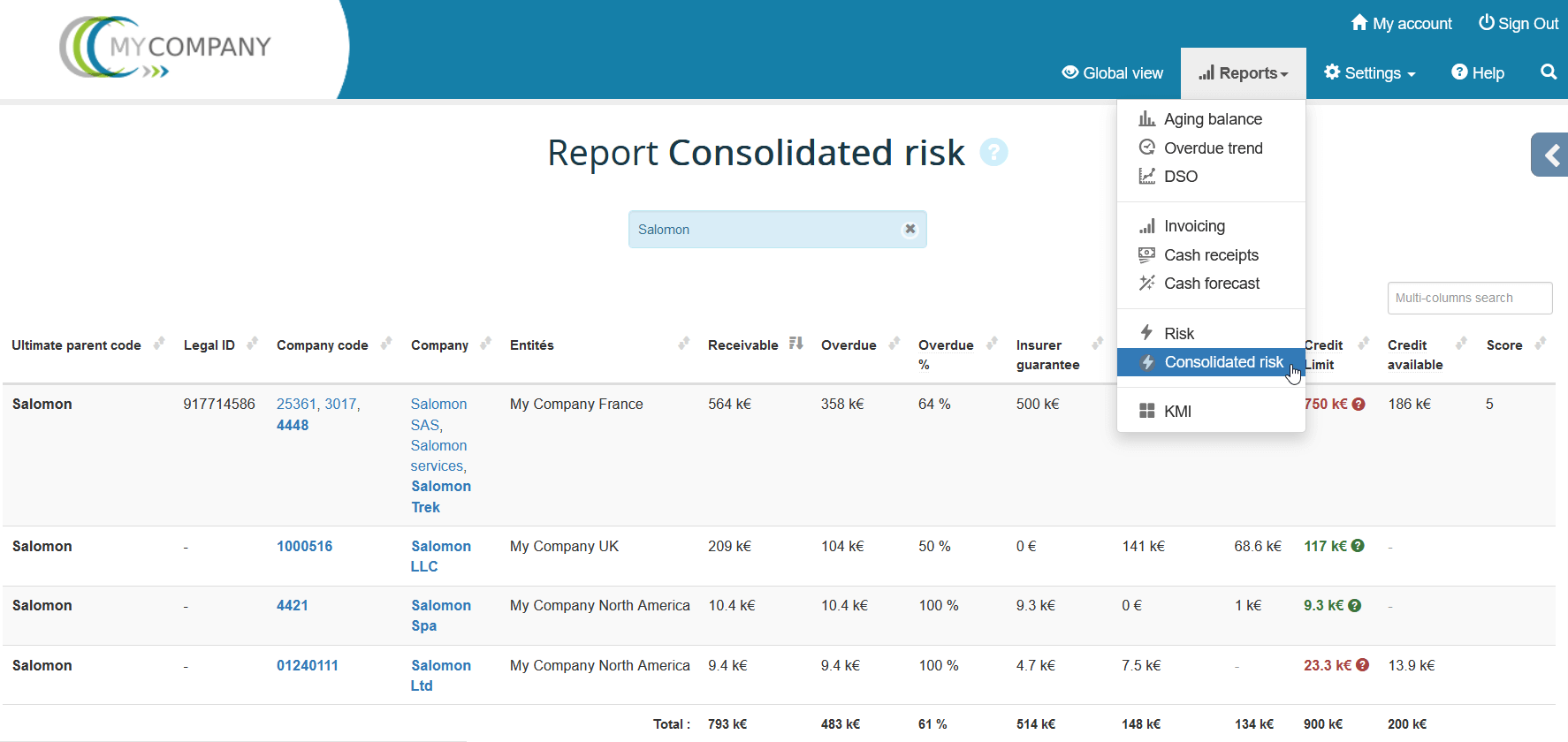

Example with the company "Salomon", customer of several entities of the group Multi in several countries:

- Add the Ultimate Parent Number in customer sheet:

- Consolidated multi-entities risk report of "Salomon":

This approach provides with unprecedented visibility which is very useful for finance as well as business.

- Add the Ultimate Parent Number in customer sheet:

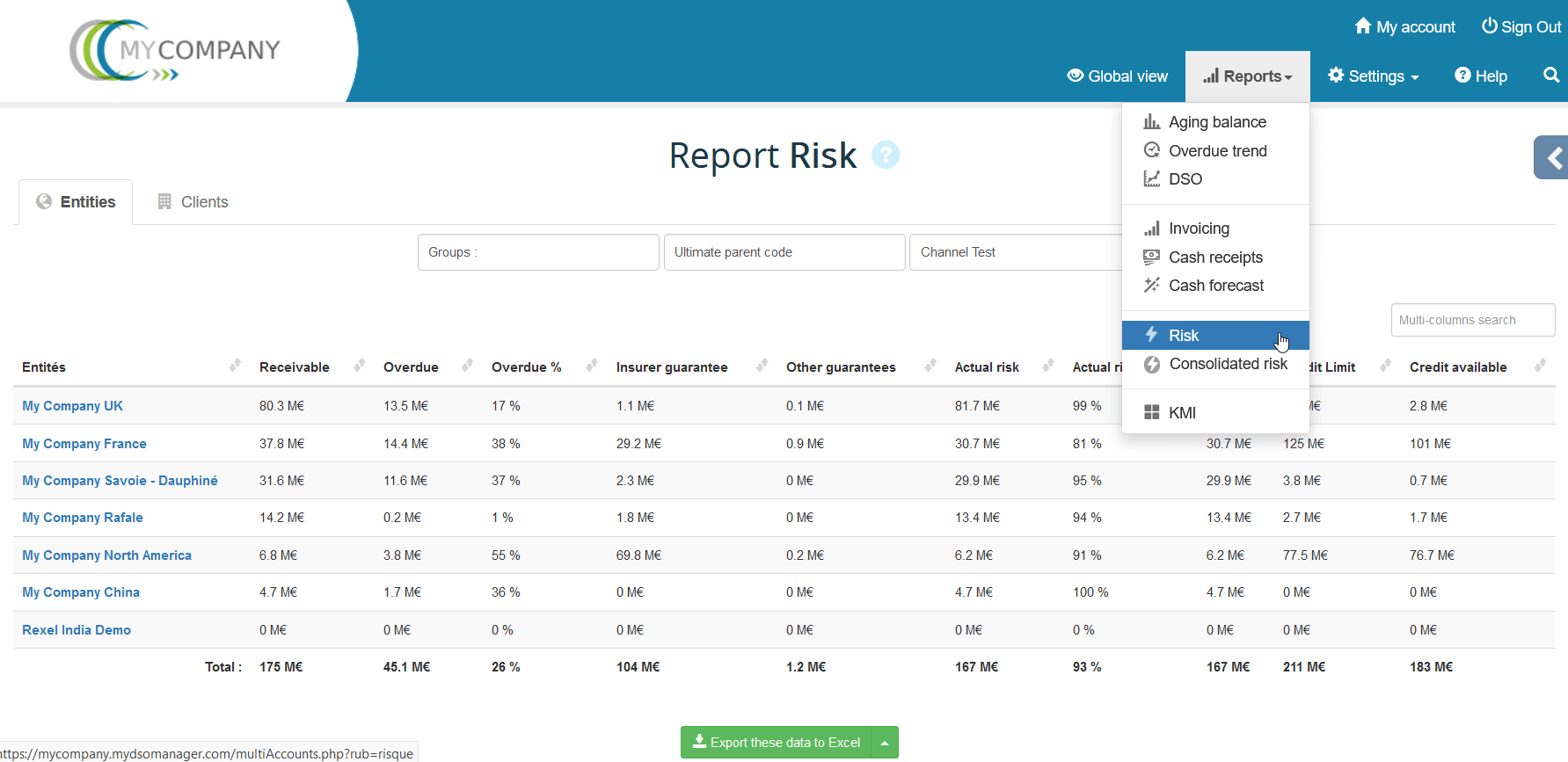

- Multi-entity risk report → What is the risk exposure of your group? Get a consolidated view with this multi-entity report detailled at entity or customer level: