Is it a revolt? No, Sire, it's a revolution!

The digital revolution is in full swing! Perhaps we are so engaged and invested on a daily basis that we fail to recognize how powerful the present developments are and how they transform firms and their connections with their business partners.Credit management is involved in all aspects of a commercial relationship, from the initial contact with customer risk management to the final stages of the sales process with dispute management, cash collection, payment, and performance management.

The race toward digitization is already well underway

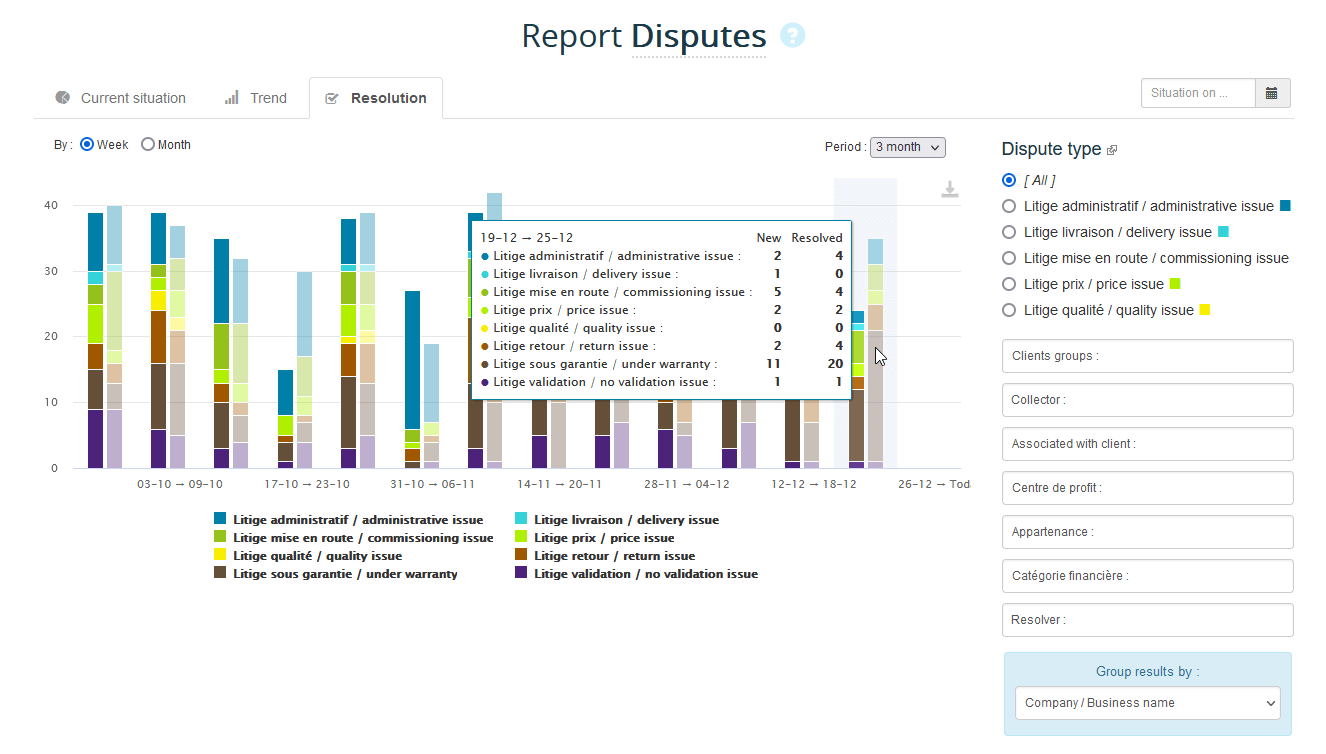

Throughout all stages, the entire relationship is becoming digitalized. It represents a great opportunity to increase productivity, quality, and performance to the point that Companies who are unwilling to invest in the appropriate digital technology risk slipping significantly behind, negatively impacting cash flow, profitability, and customer satisfaction. Worse, they overlook a significant opportunity for advancement that was previously undiscovered.Imagine a world where business relationships would be fluid and free of information gaps. A place where risk and potential evaluations are conducted instantly through interconnected tools, and where the seller's accounts receivable remains continuously aligned with each of the buyers' accounts payable accounting thanks to efficient and comprehensive digital communication. Any encountered problem would be identified and resolved in real time by all parties involved, whether on the vendor or customer side.

This is not just a pipe dream! For businesses using My DSO Manager as their credit management SaaS provider, all of the above have become a reality.

100% real-time software; which changes everything; easy and fast set up due to great import flexibility that adapts to all ERP formats; functional quality that reflects both the accounting and financial reality of credit management, its commercial dimension; and interconnection with a panel of services and platforms allowing interaction with customers, sales representatives, financial information providers, payment solutions, business intelligence tools, etc.

How can digitalized communication increase cash flow by enhancing the quality of collection?

Cash collection between professionals is above all a matter of communication. To achieve high performance, the right information must be sent to the right people at the right time, often on a large volume of clients.This is what My DSO Manager enables you to achieve, thanks to the customized interactive e-mails that include all essential information, such as balances (due, not due, potential late payment penalties, etc.), statements of accounts, links enabling clients to access their portal, invoices and online payment options. It's extremely professional rendering, whether automatic, semi-automatic, or personalized by the customer, increases the confidence of your firm on the seriousness of its management.

Consolidate your Group's outstanding balances in real time

The digitization of the customer account management is not only external, it also concerns Groups whose data is often compartmentalized within their entities and who often have different ERPs. By interfacing each of them with My DSO Manager, the software standardizes the data and allows real-time data consolidation, natively managing multi-currency, multi-language and multi-entity.Hence, the reports available in each entity are also available at the Group level for Corporate views of each performance report, such as the anticipated cash flow, the aging balance, or the credit risk exposure of a significant multi-entity customer.

Would you like to delve deeper? Find our online demonstration and / or simply contact us for a customized one with our experts in digitizing credit management.