Why should businesses manage customer risk?

While it is natural for a bank to analyze and manage the risk of not being paid or seeing loan installments not repaid by its customers, it is less so for a company, because each sale made with a payment delay is analogous to credit extended to its customer.Simply since, unlike a bank, the management of client credit is not the company's primary activity but rather a market-imposed commercial practice.

However, the risk of late payment and non-payment is very present and it could have greater consequences than it would for a financial institution that is better "armed" in terms of resources and instruments to handle it.

Therefore, managing customer risk is crucial for any B to B organization!

The good news is that there are techniques and strategies to lower this risk and perhaps turn it into a sales force..

The pillars of customer risk management in B to B

The prerequisite for any customer risk management is to develop a commercial strategy that incorporates this concept by defining standard payment terms and general terms of sale, good practices to be followed throughout the sales process, tools and services to be utilized to mitigate the detected risks, and so on.

- Credit analysis: evaluate the creditworthiness of its customers and prospects in relation to the expected volume of business and the commercial context.

- Include the payment conditions in the commercial negotiation in order to obtain installments, short payment terms and a suitable means of payment.

- Define a credit limit per buyer or legal identifier and manage it throughout the business relationship.

- Securing outstanding amounts is considered risky without appropriate tools and/or payment terms. or example, using credit insurance is particularly useful for assessing and securing customer risk. The bidirectional connectors with the main credit insurers allow for highly efficient management of your credit insurance policy.

- Monitoring outstanding amounts and implementing effective debt collection.

- Enrich risk assessment by taking into account payment behavior (payer profile), internal and/or external scoring, prediction and triggering alerts in the event of a negative evolution of these indicators.

Putting these steps in place allows you to eventually integrate the dynamics of good customer risk management into your daily operations.

In addition, this has significant advantages: it raises the risk awareness of the company's actors, as well as the imperative need for turnover to be paid in order for the company to be profitable; it limits commercial prospecting to solvent companies only; and it professionalizes the entire sales process, particularly through the treatment of the causes of disputes.

How to implement a credit policy?

The use of a dedicated credit management and debt collection software is essential if you want to be efficient and responsive.Indeed, adapted functionalities that allow for being fast and relevant without losing any information, performance reports calculated in real time, and full collaboration between the various actors of the company are prerequisites for any risk management that fits in time.

In addition, software makes it possible to link credit risk management and collection in order to combine all the information from the customer relationship into its decisions.

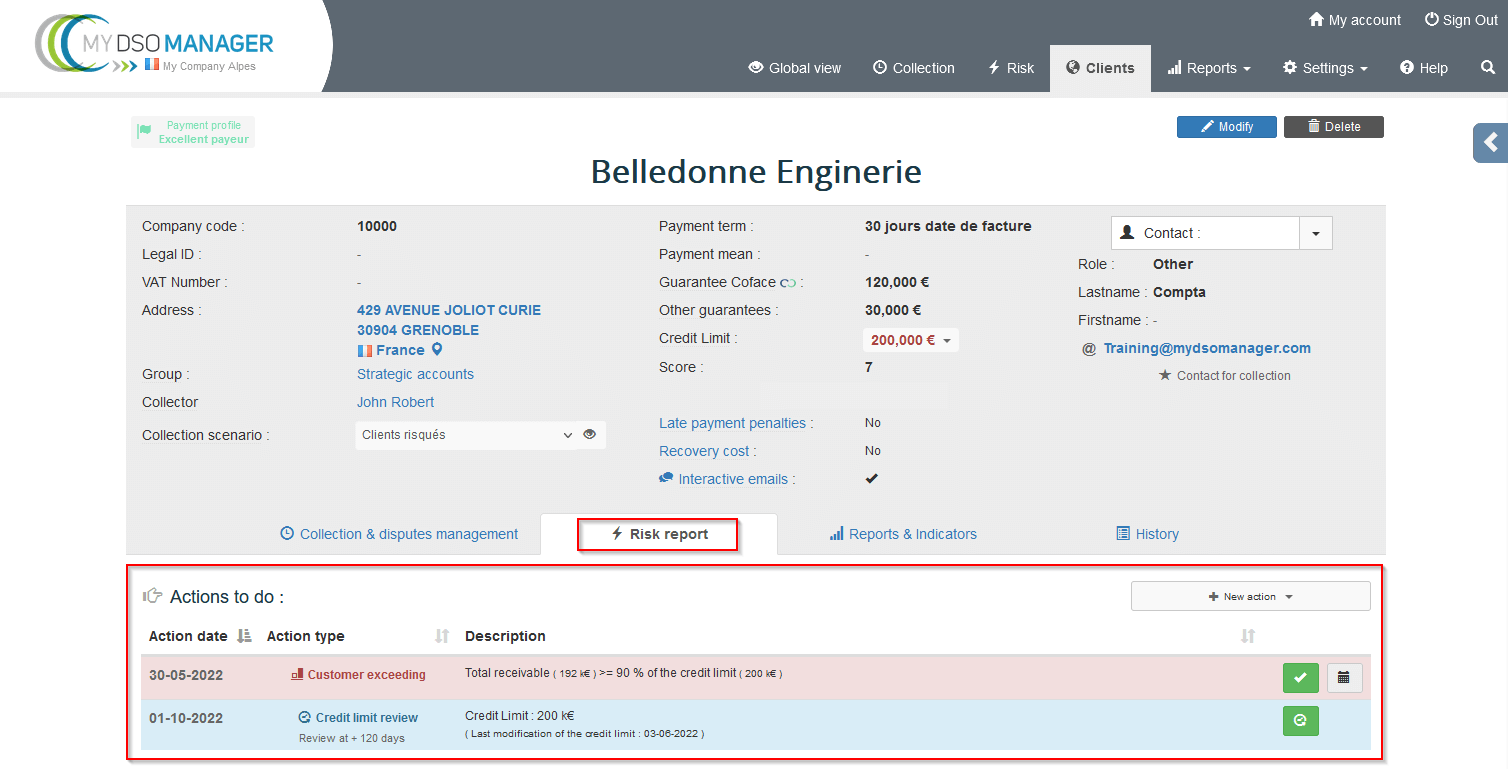

Credit analysis at the customer level, by legal entity, or grouping code for multi-entity customers Monitoring credit insurance amounts and other guarantees, credit limits, outstanding amounts, and internal and external scoring in a few clicks provides comprehensive and clear visibility leading to relevant positions and decisions.

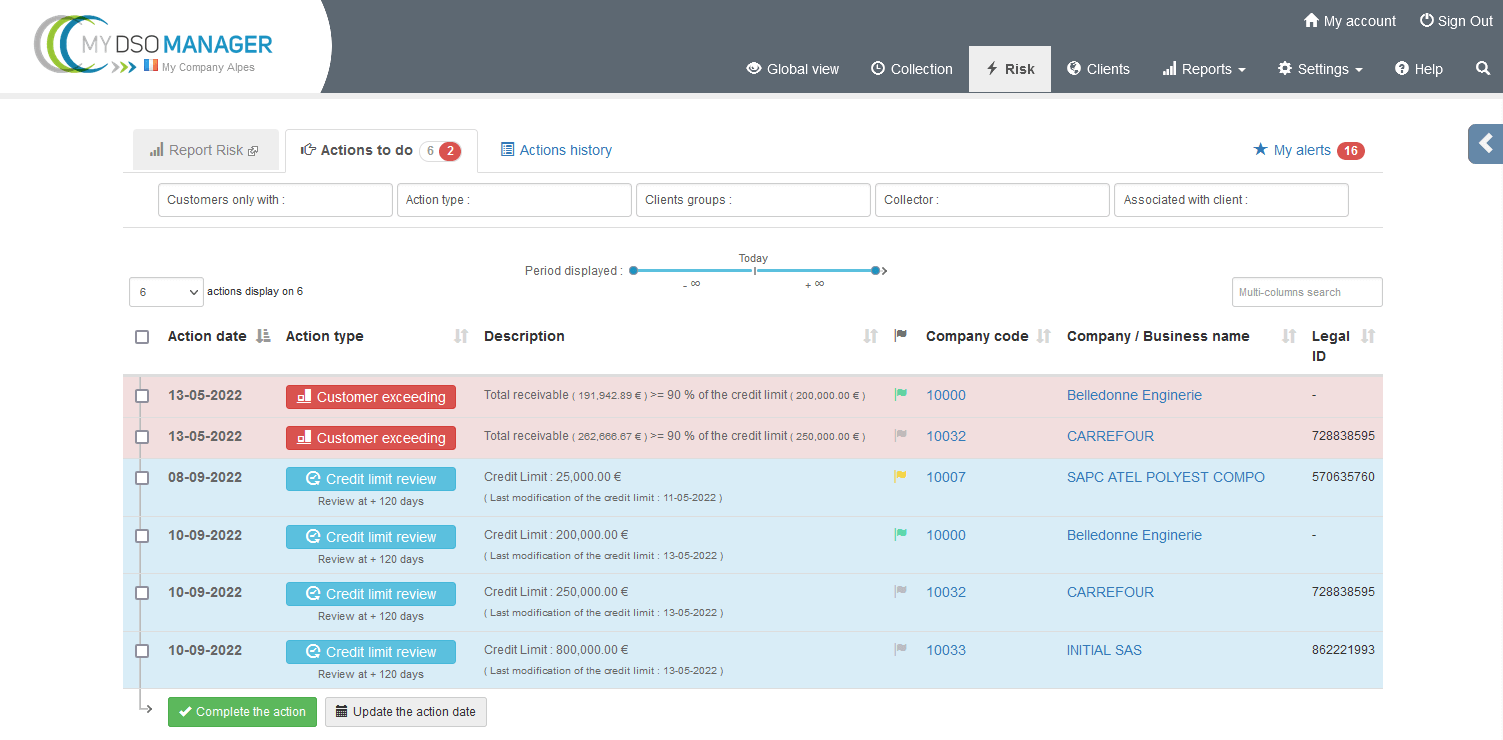

The credit limit validation workflow, the risk agenda and the multi-criteria alerts all lead to being action-oriented for optimal follow-up of risky customers and special cases.

Are you a Multi-entity, multi-country group with global clients? Consolidate the data of these large accounts thanks to a grouping code imported or managed directly in the solution in order to visualize at a glance all the outstandings, possible delays, guarantees, and credit limits at the group level. Example of a report showing all data for global customer "Salomon" :

The goal of credit management is to promote the increase of turnover by limiting risks in order for the company to be successful in terms of cash flow, profitability, credibility, and customer satisfaction.

My DSO Manager allows this qualitative management of a large volume of customers by intelligently highlighting those on which it is necessary to act for each of the actors of the company: credit manager, credit analyst, collection officer, commercial manager, management controller, etc.

The ultimate collaborative solution, It is the core place where customer and accounting data, as well as financial and security information, are integrated. It provides everyone with access to the prism corresponding to their role to create fluidity in the relationship of a company with its customers in the assessment of risk, the management of trade receivables and disputes, and the analysis of performance.

The ultimate collaborative solution, It is the core place where customer and accounting data, as well as financial and security information, are integrated. It provides everyone with access to the prism corresponding to their role to create fluidity in the relationship of a company with its customers in the assessment of risk, the management of trade receivables and disputes, and the analysis of performance.