How to create advanced Scoring with AI Search & Assign?

One of the pillar of the credit manager profession is the ability to assess the solvency and credit risk of their company's customers. There are several approaches and methods for this that have evolved significantly in recent years thanks to the availability of information and the development of digital solutions that allow them to be interpreted using increasingly sophisticated and relevant algorithms.

Thus, financial information providers and credit insurers have become masters in credit analysis and business scoring, and offer services for sharing this information and analysis for the former, and guarantees against the risk of late payment and unpaids invoices.

Among the progress made, the inclusion of financial data, but also those of sectors of activity, or even payment behavior of companies, increases the reliability of scoring.

Thanks to our connectors, it is very easy to integrate and use the information from these service providers in your My DSO Manager platform, as soon as you are registered as a customer with them.

Taking this information into account allows you to transform a cold assessment disconnected from your relationship and your challenges, into a complete analysis, mixing information from third parties, your own experience with your clients, your own commercial challenges. The risk assessment is therefore much more relevant and leads to more informed decision-making.

This is what we offer you with Search & Assign!

Find below a simplified example on our demo platform My Company SAS where an external score will be enriched with the "internal" payment profile of your clients.

My Company SAS integrates into My DSO Manager data from a financial information provider offering a risk class comprising four values: A, B, C and D. A being the best rating. Find here the list of providers connected to My DSO Manager.

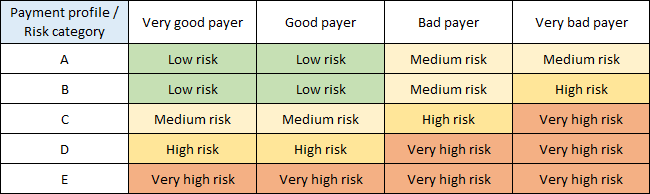

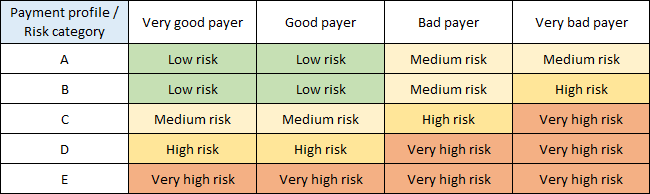

In addition, My Company SAS customers are rather recurrent with many payment experiences, which makes it possible to determine a relevant payment profile. See how to configure payment profiles in My DSO Manager. We will therefore combine this information to determine a score that combines external assessment and internal experience by creating several categories represented in this table with the external risk category on the abscissa and the My DSO Manager payment profile on the ordinate:

Each box is completed with the desired risk category and created in My DSO Manager as many Customer Groups, i.e. four categories: low, medium, high and very high risk. See how to create customer groups.

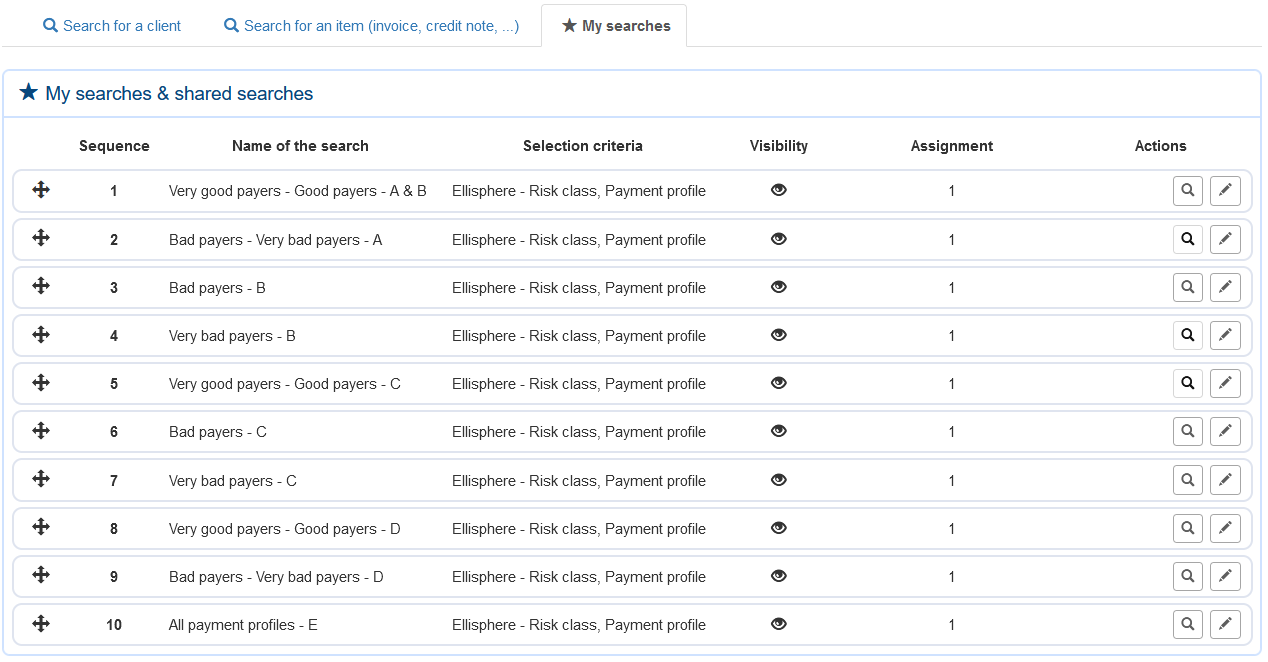

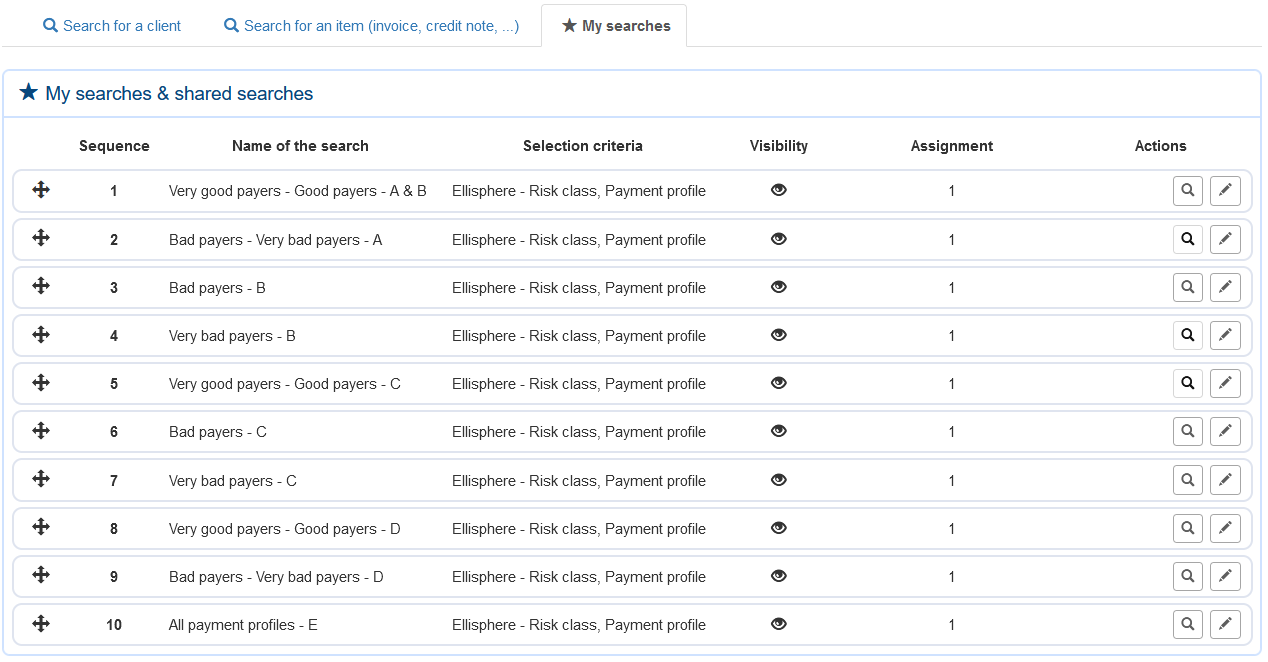

The approach consists of creating as many searches as there are boxes in the table. That is, a search selecting "Very good payers" customers with a risk category of "A", another with "Very good payers" customers with a risk category of "B", etc. In this case, 10 searches are to be created and saved.

Then, in Search & Assign, in the "Groups" section, perform the assignment rules between searches and groups as follows:

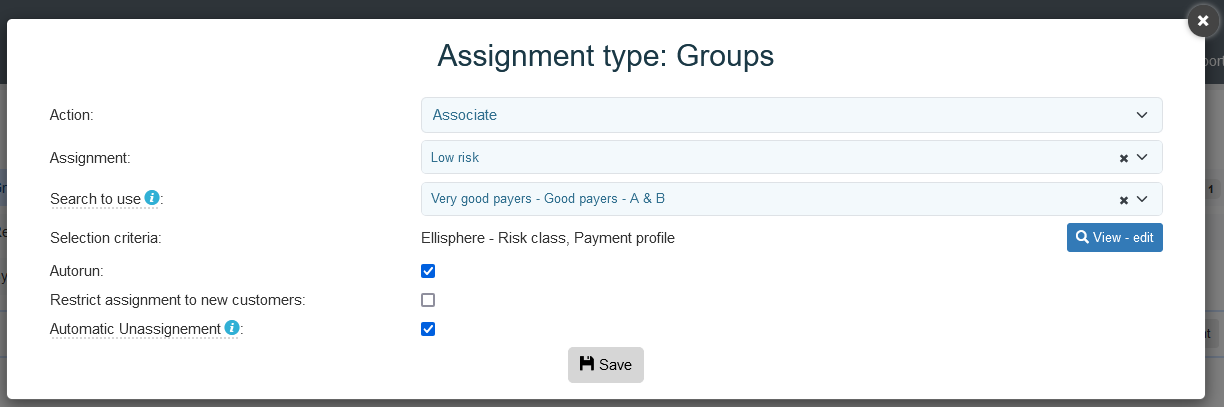

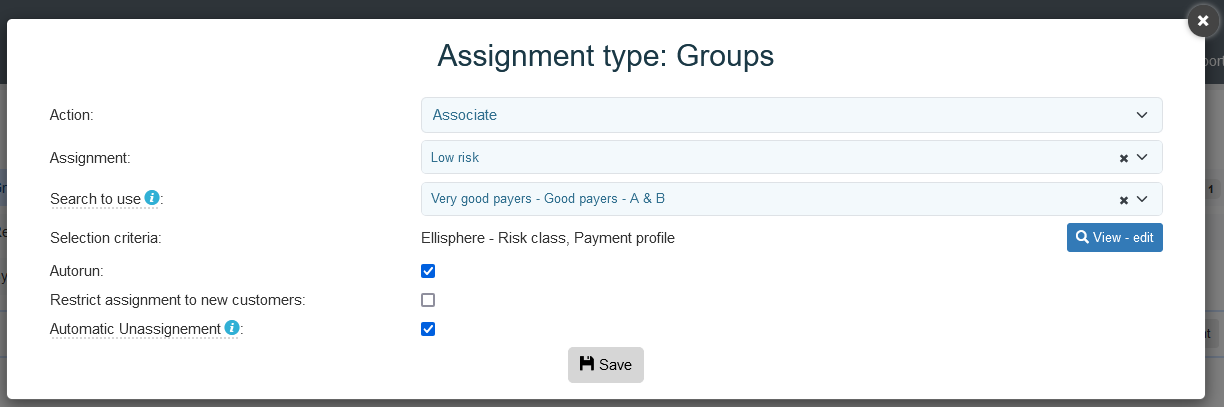

Create the assignment rules as follows:

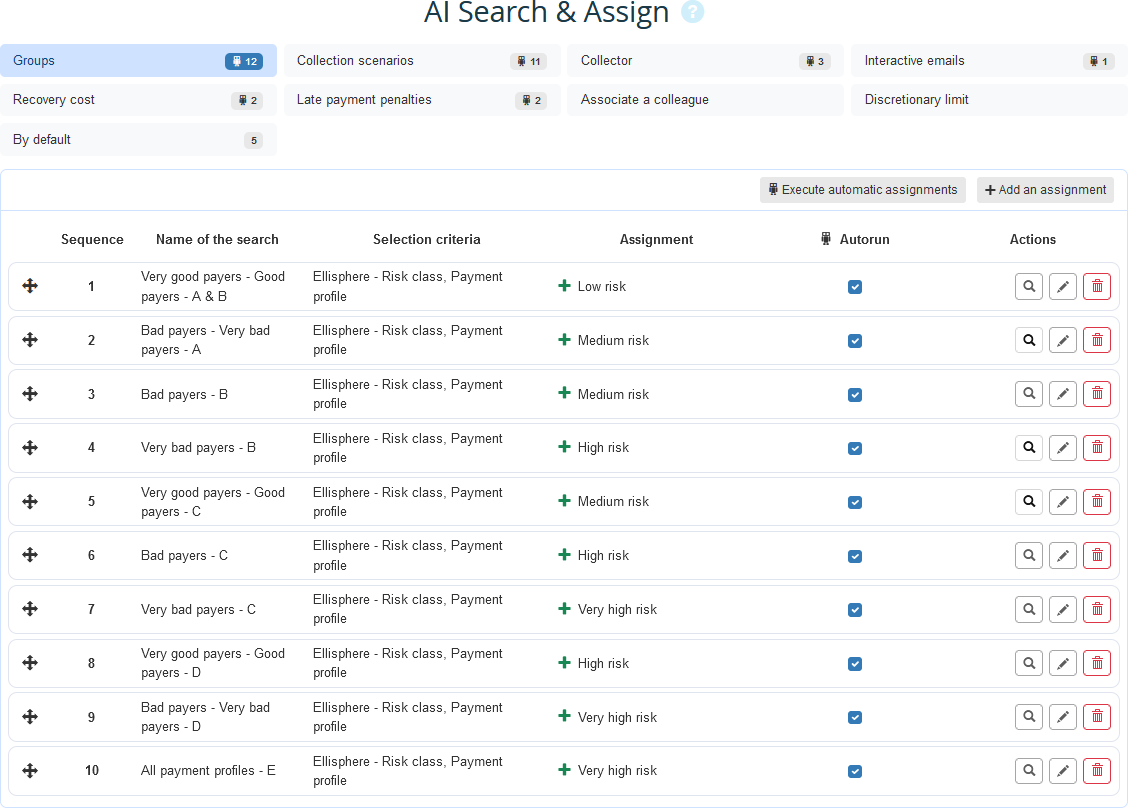

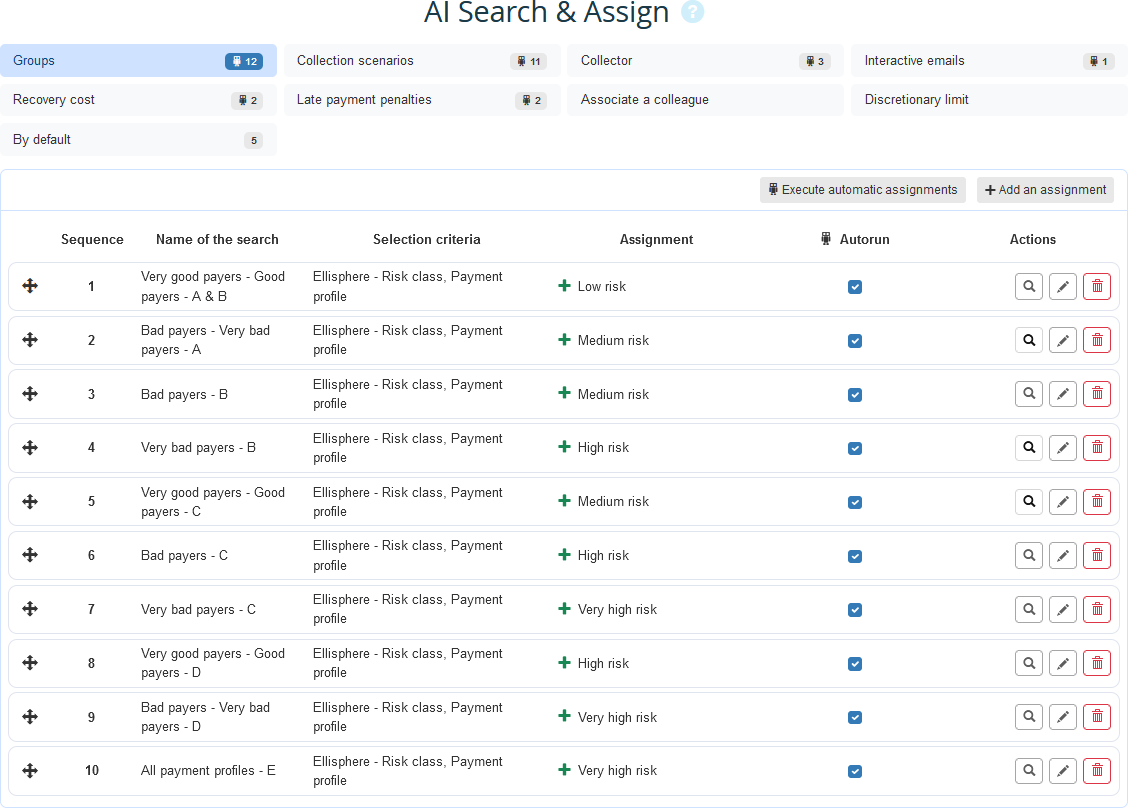

To obtain:

Thus, My DSO Manager will automatically assign the correct category to each customer every day, or even several times a day depending on the frequency of imports.

The collection agenda and risk agenda, all reports can be filtered by this enriched risk category.

This notion of enriched risk category can also be used for other settings, such as the dynamic assignment of collection scenarios, the management of collection officers' portfolios, the activation of late payment penalties, etc.

As you will have noticed, this is a scoring that is simple and very dynamic, automatically and integratedly linking data that is not usually linked. And this is what gives it its value, makes it scalable, and all the more relevant as it is then itself used concretely for other actions and settings.

Thus, financial information providers and credit insurers have become masters in credit analysis and business scoring, and offer services for sharing this information and analysis for the former, and guarantees against the risk of late payment and unpaids invoices.

Among the progress made, the inclusion of financial data, but also those of sectors of activity, or even payment behavior of companies, increases the reliability of scoring.

Thanks to our connectors, it is very easy to integrate and use the information from these service providers in your My DSO Manager platform, as soon as you are registered as a customer with them.

If these expert analyses are relevant for evaluating a company, do they cover all of your needs for assessing credit risk and business opportunity? Not quite.

Indeed, a credit analysis carried out by a well-informed specialized company is interesting, but what would you say if you could couple the characteristics of your relationship with this customer to this assessment? Is this a strategic client or a new client, a long-standing partner with whom you have close relationships? etc. What is your experience with this company?Taking this information into account allows you to transform a cold assessment disconnected from your relationship and your challenges, into a complete analysis, mixing information from third parties, your own experience with your clients, your own commercial challenges. The risk assessment is therefore much more relevant and leads to more informed decision-making.

This is what we offer you with Search & Assign!

First step, define the rules for advanced scoring

Find below a simplified example on our demo platform My Company SAS where an external score will be enriched with the "internal" payment profile of your clients.

My Company SAS integrates into My DSO Manager data from a financial information provider offering a risk class comprising four values: A, B, C and D. A being the best rating. Find here the list of providers connected to My DSO Manager.

In addition, My Company SAS customers are rather recurrent with many payment experiences, which makes it possible to determine a relevant payment profile. See how to configure payment profiles in My DSO Manager. We will therefore combine this information to determine a score that combines external assessment and internal experience by creating several categories represented in this table with the external risk category on the abscissa and the My DSO Manager payment profile on the ordinate:

Each box is completed with the desired risk category and created in My DSO Manager as many Customer Groups, i.e. four categories: low, medium, high and very high risk. See how to create customer groups.

If you have more Risk category or payment profiles values, group them together to have a table of maximum five columns and five rows. It is possible to do more but it would complicate the configuration and use of advanced scoring.

Second step: implementation with Search & Assign

The approach consists of creating as many searches as there are boxes in the table. That is, a search selecting "Very good payers" customers with a risk category of "A", another with "Very good payers" customers with a risk category of "B", etc. In this case, 10 searches are to be created and saved.

Then, in Search & Assign, in the "Groups" section, perform the assignment rules between searches and groups as follows:

Create the assignment rules as follows:

To obtain:

Thus, My DSO Manager will automatically assign the correct category to each customer every day, or even several times a day depending on the frequency of imports.

The collection agenda and risk agenda, all reports can be filtered by this enriched risk category.

This notion of enriched risk category can also be used for other settings, such as the dynamic assignment of collection scenarios, the management of collection officers' portfolios, the activation of late payment penalties, etc.

As you will have noticed, this is a scoring that is simple and very dynamic, automatically and integratedly linking data that is not usually linked. And this is what gives it its value, makes it scalable, and all the more relevant as it is then itself used concretely for other actions and settings.