Credit insurance: submit your guarantee requests using My DSO Manager!

Credit insurance connectors are evolving!

Credit insurers API connectors are the true pillars of efficient management of your credit insurance policy. They allow you to synchronize credit insurance data (guarantees granted, types of guarantees, scores, etc.) with your Trade receivable data on a daily basis, as well as any other type of external data like financial information, integrated into My DSO Manager.

Credit insurance is a service that meets several of the credit manager's objectives:

Previously designed to integrate information into My DSO Manager, the connectors can now be used to send information to credit insurers, thus increasing the level of interaction and integration of each policy's management processes.

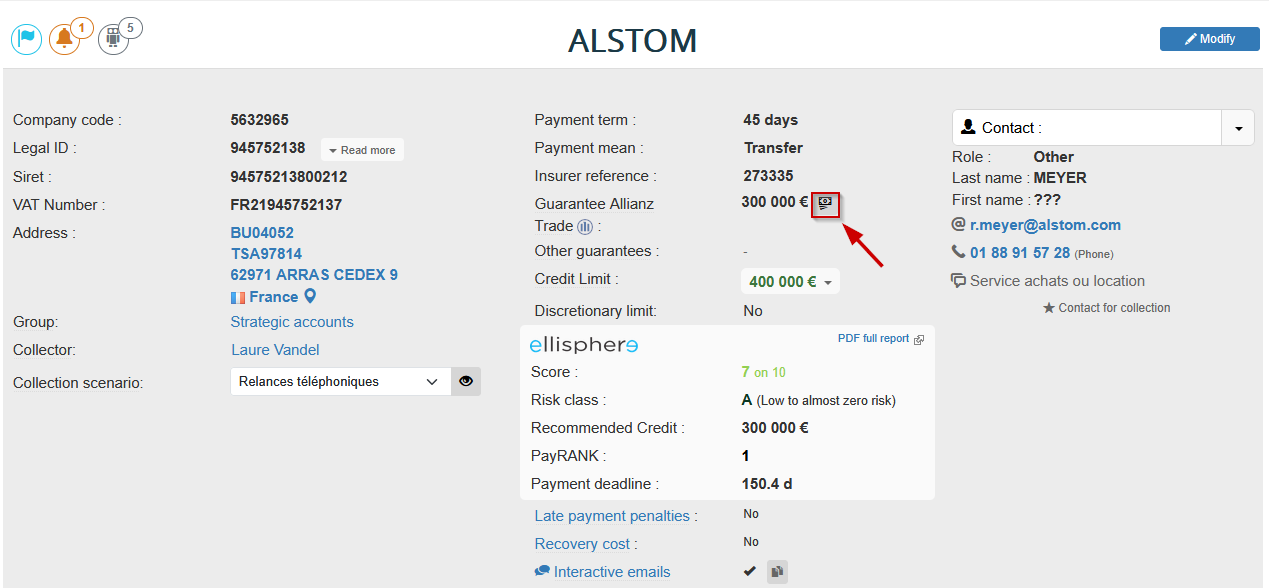

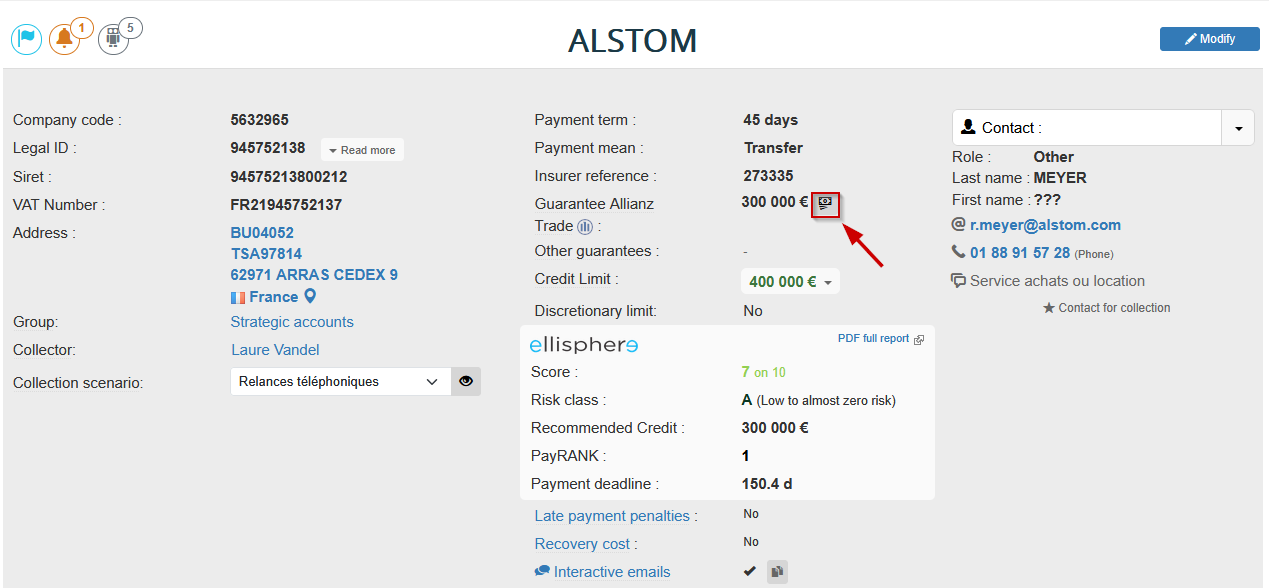

Once the connector with your credit insurer is activated, you can request guarantees from the customer file in My DSO Manager:

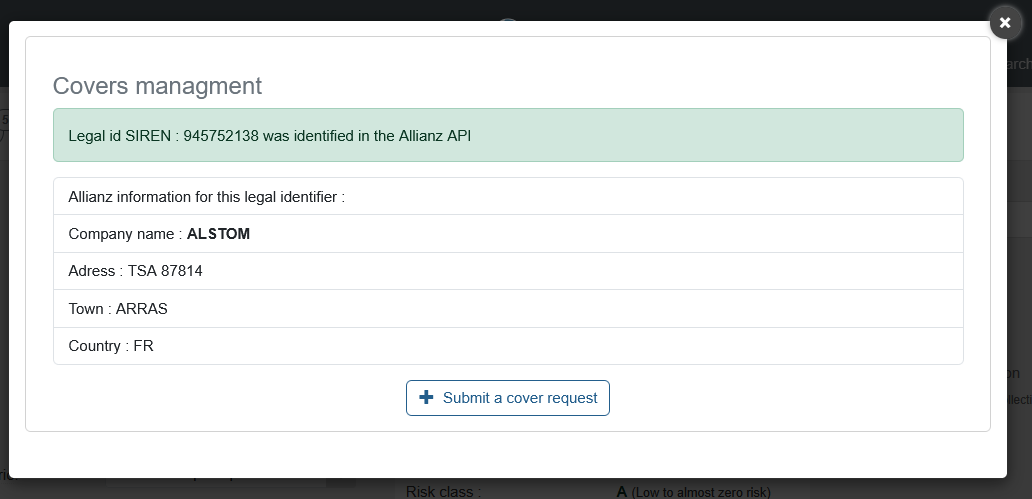

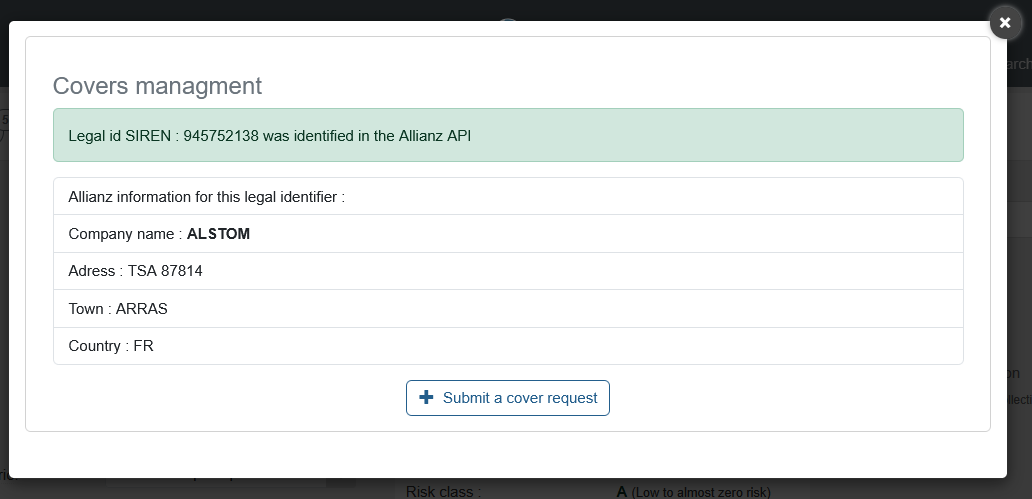

Intermediate step for the buyer to be positively identified by the credit insurer:

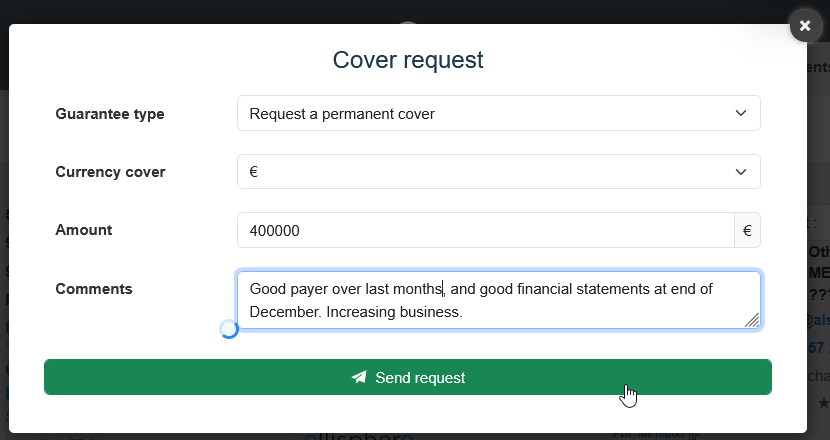

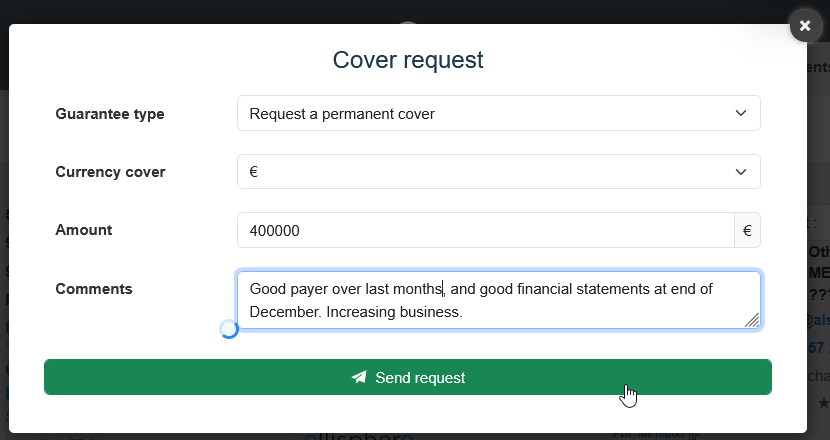

Select the type of guarantee and the desired amount:

Let's go! The credit insurer's response will be automatically integrated into the software.

This development opens up new possibilities in addition to existing ones. Indeed, thanks to the risk management features available in the software, optimal, real-time management of credit insurance can be implemented across all aspects:

This email is logged, allowing for traceability of all inquiries made.

A question about credit insurance? Ask MAIA or consult our online help on credit insurance.

MAIA or consult our online help on credit insurance.

Credit insurers API connectors are the true pillars of efficient management of your credit insurance policy. They allow you to synchronize credit insurance data (guarantees granted, types of guarantees, scores, etc.) with your Trade receivable data on a daily basis, as well as any other type of external data like financial information, integrated into My DSO Manager.

Credit insurance is a service that meets several of the credit manager's objectives:

- Continuously perform a credit risk assessment on each of the clients included in the insurer's portfolio. The buyer's potential financial difficulties are identified upfront, allowing for the anticipation of the risk of non-payment.

- Obtain a guarantee to be compensated up to the guaranteed covered % in the event of non-payment. A key element of this service, compensation helps maintain the profitability of your business by obtaining compensation in the event of proven non-payment and falling within the scope of guaranteed receivables. To achieve this, it is essential to comply with the contractual clauses of the policy. Otherwise (late declaration, misinterpretation of contract clauses, etc.), there is a risk of not being covered and thus losing the right to compensation.

- Help structure the sales process and define receivables management rules based on those in the insurance policy.

- Have an outsourced debt collection service. Credit insurers offer this service for both secured (following compensation) and unsecured (when the guarantee is void) receivables. Acting in a similar manner to a debt collection agency, the insurer has additional levers to achieve its goals, which are often effective.

Two-way credit insurance connectors

Previously designed to integrate information into My DSO Manager, the connectors can now be used to send information to credit insurers, thus increasing the level of interaction and integration of each policy's management processes.

Once the connector with your credit insurer is activated, you can request guarantees from the customer file in My DSO Manager:

Intermediate step for the buyer to be positively identified by the credit insurer:

Select the type of guarantee and the desired amount:

Let's go! The credit insurer's response will be automatically integrated into the software.

Towards optimal credit insurance management

This development opens up new possibilities in addition to existing ones. Indeed, thanks to the risk management features available in the software, optimal, real-time management of credit insurance can be implemented across all aspects:

- Monitoring of actual risk (outstanding receivables - guarantees) and potential risk (outstanding receivables + order portfolio - guarantees) in real time in the Risk report.

- Alerts in the event of overruns or in the event of a risk of default or foreclosure.

- Workflow for validating credit limits when they exceed the guarantee amount and credit limit reviews.

- Automatic and manual follow-up actions in the Risk agenda.

- Use of credit insurance data for intelligent configuration via Search & Assign AI.

- Customized reports for turnover declarations to the credit insurer.

- Management of unnamed guarantees and limits Discretionary (DCL).

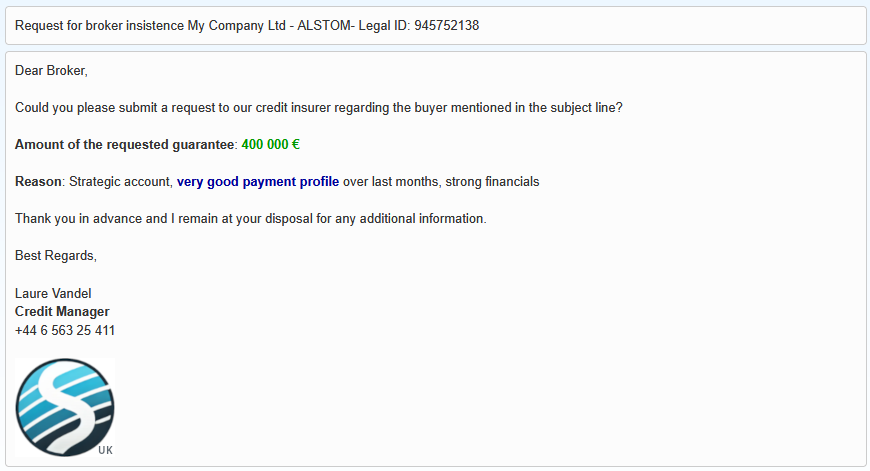

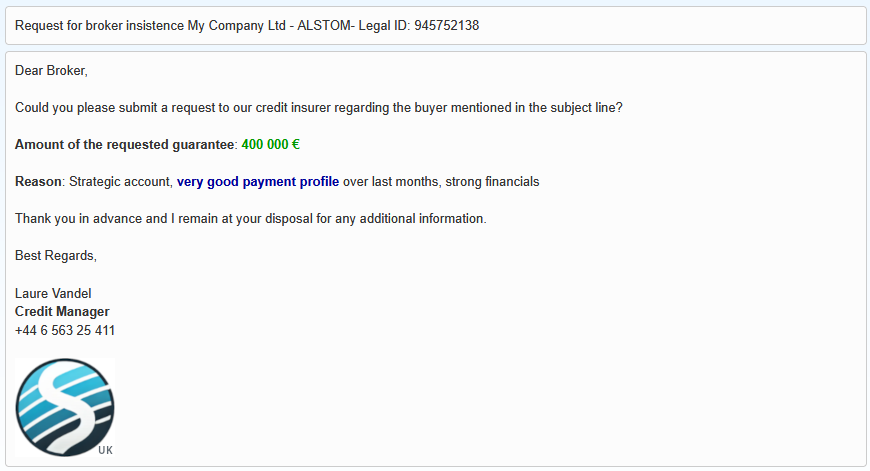

- Exchanges with the broker, particularly for requests for insistence.

- Etc.

Thus, My DSO Manager enables integrated and optimal credit insurance management, whether for reporting claims on time, managing different types of coverage, submitting warranty requests, or all operations that combine credit insurance contract management with efficient management of your company's receivables.

The insurer's response is negative? Submit an inquiry from the "Credit & Risk Report" tab of the customer profile with an automatically generated email based on your preferences, completed with the information you wish to transfer to support your request, such as your credit analysis comments, or information from your financial information provider.

This email is logged, allowing for traceability of all inquiries made.

A question about credit insurance? Ask

MAIA or consult our online help on credit insurance.

MAIA or consult our online help on credit insurance.